An analysis on Printing and circulation of Paper Money -1

Circulation of Paper Money via-a-vise

-Analysis-

– 1–

Deriving necessary statutory powers from Section 22 of the RBI Act 1934 , RBI began its operation of issue and Circulation of Paper Money called Currency or Bank Notes which became one of its core banking functions. Since then Reserve Bank has been responsible for the design, production and overall management of the issue and circulation of Bank Notes in consultation with Government of India, all of the Bank Notes embedded with several security features .

Though under the RBI act 1934, the Reserve Bank is authorised to issue Bank notes in different denominational values, the act did not permit issue of denominational values beyond ten thousand rupee Bank Notes. Presently the Bank Notes are issued in the denomination of Rs.5/-, Rs.10/-, Rs.20/-, Rs.50/-, Rs.100/-, Rs.500/- and Rs.1,000/- only. Paper Currencies in denominations like Re.1/- and Rs.2/-, Rs 50,000/- and Rs 10,000/- which were in circulation at certain periods of years have since been discontinued totally, in different periods, for different reasons which will be discussed later. Bank Notes valued Re.1/- and Rs.2/-have been coinised. Though Rs 5/- denominational Bank Notes are not in continuous printing program, it is printed at some short intervals and discontinued. However as per RBI notification Bank notes in those two denominations issued earlier are still valid and are in circulation to the extent they are available. Read RBI version on the issues.

Quote:-

Volume-wise, the share of such small denomination banknotes in the total banknotes in circulation was very high but in terms of value they constituted a very small percentage. The average life of these banknotes was found to be less than a year. The cost of printing and servicing these banknotes was, thus, not commensurate with their life, and printing of these banknotes was, therefore, discontinued. These denominations were coinised. However, Rs.5 was re-introduced in 2001 to supplement the gap between the demand and supply of coins in this denomination. The printing of Rs.5/- banknotes has been discontinued from the year 2005. (Ref: Currency Matters/ Frequently asked Questions)

Unquote-

To facilitate the distribution of notes and rupee coins across the country, the Reserve Bank has authorised select branches of banks to establish currency chests through which the Bank Notes are issued for circulation. At present it is understood that there is a network of 4,281 Currency Chests to hold and distribute Bank Notes .

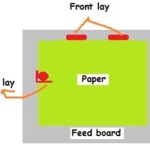

Till few years back, the Bank Notes were printed in three presses, two in Nasik and the other at Dewas, all of which functioned under Department of Economic Affairs, Ministry of Finance, Govt of India. Later Bharatiya Reserve Bank Note Mudran Pvt. Ltd. (BRBNMPL), a wholly owned subsidiary of the Reserve Bank, also set up printing presses at Mysore in Karnataka and Salboni in West Bengal. They too carried out the same operation. Now the Mints and Security presses working under the Ministry of Finance have been amalgamated under one unit called Security Printing and Minting Corporation of India Limited (SPMCIL).

Most of the said security presses also work overtime in two or three shifts to meet the annual requirements raised by RBI. Reserve Bank estimates the annual quantity of notes (denomination-wise) required and place Indents (requirement) for printing them with the above mentioned presses from where the supplies are made. It will be difficult to answer in brief the extent of demand for Currencies and Coins as several issues are involved in the demand and supply of Coins and Currencies and the quantum of demands varies from year to year. It is suffice if one understand the fundamental principle under which the Paper Money or Coinage issuance takes place. This article however will confine to only Paper money called Bank Notes issues and not dwell upon the subject on issuance of Coins.

Every Nation has their own Currencies or Bank Note issuing authorities who also play certain role in shaping up the financial policies of the Govt as they indirectly form one principle factor for the issuance of Paper money. Just pumping the printed Paper money in to circulation to meet financial constraints will only raise inflation destroying the economic fabric of the country. Paper money cannot be released just like tokens. While some form of Currencies called Bank Notes and Coins will be necessary in order to carry out the day to day transactions in several spheres of life, in historical times before the emergence of Paper money, the transactions were done with precious Metals in lieu of Paper money. Thereafter with the advent of Paper money the liquid cash transactions with metals slowly vanished.

Let us try to understand various factors involved in the issuance of Paper money and Coins. As mentioned earlier Reserve Bank of India (RBI) is the Paper money issuing authority for the Nation as empowered under Section 22 of the Reserve Bank of India Act, 1934. RBI issue Bank Notes in the denomination of Rs.10, Rs.20, Rs.50, Rs.100, Rs.500 and Rs.1000. These notes are called Bank Notes as they are issued by Central banking institution like Reserve Bank of India. RBI estimates the total annual demand taking into consideration several factors including growth rate of the economy, the replacement demand for the soiled notes and reserve requirements etc through well researched and compiled statistical data available with them which is updated almost every day. ( as the mass requirement of paper money cannot be produced and released overnight, it is necessary to print and stock the Paper money to meet emergency exigencies). This aspect will be discussed in the succeeding chapters.

The notes issued for circulation are either in the hands of public or are kept stored in the vaults of several banks from the day the issues were regulated through well organized mechanism. However remember that the total value of Paper money and Coins in circulation and in stock will be within the total value of the reserves maintained in several forms on par with the Internationally accepted norms by the issuing Nation and the issuing authorities and they will be in terms of Gold, Foreign currencies, valid Bonds etc held against bankruptcy.

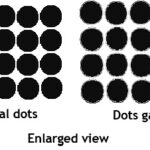

The Paper money is technically a Promissory note or a registered and accounted piece of paper and expected to be not easily duplicated by anyone due to several security features embedded in them. Through this Promissory note initially the issuing authority promised the holder of the note that the equivalent value of Gold will be given as and when required. However since the prices of Gold fluctuated this clause has probably been taken away and instead the bearer of the Paper Money are assured of payment of equivalent value in sum as indicated on the Promissory note whenever they are demanded. Therefore as per the internationally accepted norms the authorities who issue money have full backing of Gold or precious metal or some form of securities against the value of the total quantum of Bank Notes or Currencies issued. This is therefore basically Gold parity or the Gold Reserve System.

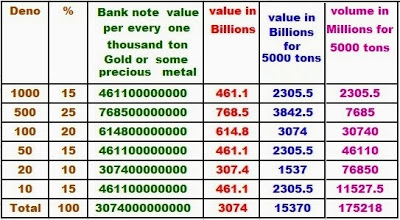

Let us briefly understand the issue pattern of Coins and Currencies by the Illustrative Model reproduced below. THE FIGURES GIVEN ARE ILLUSTRATIVE ONLY AND NOT ACTUAL. Let us assume that the issuing authorities hold 5000 tons of gold and Silver in their chest, will they then issue Currencies and Coins equivalent to their value? It is presumed to be so. When the Paper money was introduced, ‘x’ quantum of Currencies or Paper money would have been issued based on the reserves held – in terms of Gold, foreign currencies, valid bonds etc.

Let us work out the total value of 1000 ton of Gold based on the average rate which works out in Indian rupee ( per 10 gm the price is approx 30,740/-) as Rs 3,074,000,000,000/- in the illustrative example to explain the logic. How much Currency would be issued and put into circulation based on the daily usage of various denominations? The ‘X’ Quantum could have been the following (When the issuance of Paper money commenced there were several deno note in circulation which s included 10,000/-, 5000/-, 1000/, 500/- and lowest deno like 1/-, 2/- and 5/- some of which are no more printed now). This model illustrative example has been done with present set of denominations in circulation to easily understand the principle involved:-

While the printing and issue of the Currencies were linked to the Gold reserve of a country, neither the basis on which the Paper Money was issued by the then private banks prior to their amalgamation with RBI nor the modus operandi of the transaction or to the extent to which the Paper Money were issued remain sketchy and unknown till 1974 from which the data is available. One aspect is clear to the extent that the issuing authorities, whichever nation they represent and whoever issue Paper money will have control over the yellow metal or other precious metal stocks to offer safety against the Paper money being circulated. However prior to take over by RBI the then existed Banks issued their own Paper Money based on mutual trust and good will of the trading community.

Why Yellow metal only and why not other precious metals like Silver ? May be not necessary that only Gold reserve be kept against the value of Currencies in circulation under issue as there are internationally accepted norms such as reserve foreign exchange, internationally acceptable security bonds , Silver etc also form part of it. It is understood that even internationally accepted foreign exchange in Currencies can be held in addition to the precious metals. In short it is sufficient if we understand that all such measures are for the purpose of safeguarding or honoring the promised value of the issued Paper money against bankruptcy.

Recent Comments