An analysis on Printing and circulation of Paper Money – 2

-Analysis-

Quote:

”The long term annual growth rate of currency circulation has in fact gone up from around 12 per cent during 1971-81 to 14 per cent during 1981-91 and nearly 15 per cent in the last decade. In a vast country like India with its wide geographical spread, predominance of cash as a mode of payment and a high degree of regional variation in income, expenditure and spending patterns, management of currency is undoubtedly a challenging task.” (Ref :- Introduction, Para 6 in Modeling Currency Demand in India: An Empirical Study)

Unquote-

In India, people have marked preference over handling of cash instead of credit or debit cards. This is one of the reasons why the Currencies or Bank note circulation is very much on the higher side in India compared to other countries. Generally though it is officially believed that the life span of a note is six months to one year or so, it is practically not withdrawn within the period due to ever increasing demand of cash amongst the lower and middle income group of people who continue to use and keep them in circulation without returning to them to the banks for exchange, which otherwise would not have been reissued by the banks beyond certain point.

When we study the requirement (Indent) pattern of RBI together with the supplies and notes in circulation, it gives an impression that on an average reserve stock of 15- 16 % of the notes in circulation are produced every year which includes notes for replacement against soiled notes and fresh inflow of notes to take care of inflation or higher GDP (Gross Domestic Product index). However the fact is otherwise. Annually Reserve Bank puts up Indent for printing nearly 30 % of the total Bank Notes in circulation in various denominations.

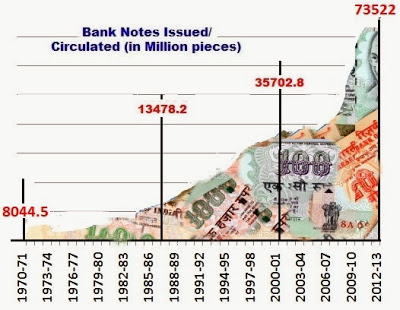

The total value of bank notes in circulation at the end of March 2013 was 11648** billion rupees (Rs 11648000000000/-) equivalent to 73522 million pieces of notes in various denominations. It was 8044.45 million pieces of notes during 1970-71. At mid point periods ie in the first decade 1987-88 when Rs 500/- denominations were introduced the circulation was 13478.2 million pieces including higher denomination like Rs 500/- and during 2000-2001 when Rs 1000/- denomination was also introduced, the circulation went up to 35702.8 million notes of different denominations.

Prior to independence, denominations like Rs 1000/-, Rs 5000/- and Rs 10000/- were also in circulation. But in the year 1946 two denominations i.e Rs 1000/- and Rs 10000/- were demonized to curb unaccounted money. After few years the same three sets of denominations were re issued in 1954, and once again demonetized in the year 1978. All those denominations were issued in a limited quantity. (Ref: Frequently asked questions under Chapter Currency: http://www.rbi.org.in/scripts/FAQ).

Subsequently out of the three denominations demonetized, only Rs 1000/- deno was re-introduced in the year 2000. Prior to issue of Rs 1000/- , a newer denomination in the value of Rs 500/- was introduced in the year 1987-88. Therefore the data has been compiled only from 1974 onwards by not taking into consideration the demonetized issues of Rs 1000/-, Rs 5000/- and Rs 10000/- denominations which were very limited in circulation.

Against this background let first analyze the issue and circulation of Bank notes in various denominations to understand the quantum of money that were issued both in value as well as in volume. The graph for the period from 1974 to 2013 has been split into two parts, one to show the overall volume and value and the other to show the variation in the quantum issued / circulated every one decade (10 years).

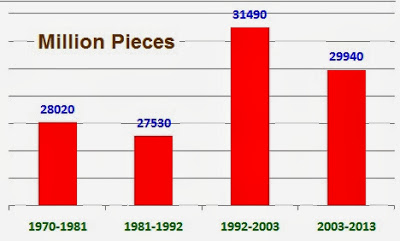

printed and issued in a span of 43 years i.e from 1970 to 2013. The

second graph (volume in million pieces) shows the same

trend of issue/ circulation every 10 years

(i) Marginal decrease in the issue/circulation by 2 % in the next 10 years i.e 1981-1992.

(ii) During 1992-2003 increase in issue/ circulation by approximately 14.4 % compared to 1981-92.

(iii) Marginal decrease in issue/ circulation in the next ten years i.e 2003-2013 to the extent of 5 % compared to previous ten years.

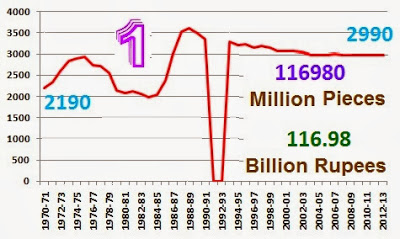

This denomination has been totally Coined. Though the printing and fresh issue of this denomination has been discontinued, whatever quantum is in circulation is still considered to be legal tender. It is presumed that the soiled currency in circulation is being slowly withdrawn and not reissued again. Since RBI realized that though volume-wise, the share of this denomination in the total banknotes in circulation was very high, in terms of value they constituted a very small percentage, cost of printing of this deno was high and re issues not commensurate with their life, further printing and fresh issues of these banknotes has been discontinued.

Bank notes to the extent of only 2990^^ million pieces (2.99 billion rupees) of Rs 1/- denomination are in circulation in the year 2012-2013 which works out to 2.55 % of the total notes issued in 43 years. (^^Ref:- Database on Indian Economy/ RBI Data Warehouse: Table 159 : Notes and Coins Issued)

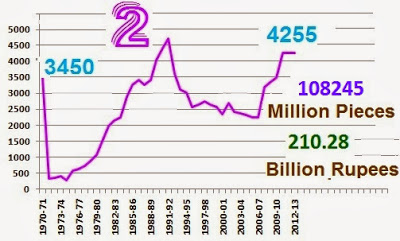

printed and issued in a span of 43 years i.e from 1970 to 2013. The

second graph (volume in million pieces) shows the same

trend of issue/ circulation every 10 years

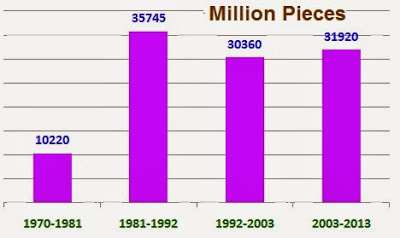

Total quantum of Rs 2/- denomination Bank Notes issued/circulated in 43 years (1970-2013) have been 108245 million pieces. If we keep the first 10 years issue figures as base, then the position of issue/circulation works out as below:

(i) Increase in the issue/circulation by 3.5 times in the next 10 years i.e 1981-1992.

(ii) During 1992-2003 decrease in issue/ circulation by 15 % compared to 1981-92 issues may be due to issue of Coins in place of Bank notes of this denomination.

(iii) Marginal increase issue/ circulation in the next ten years i.e 2003-2013 to the extent of 3 % compared to previous ten years.

Though the printing and fresh issue of this denomination has been discontinued, whatever quantum is in circulation is still considered to be legal tender. It is presumed that the soiled currency in circulation is being slowly withdrawn and not reissued again. Since RBI realized that though volume-wise, the share of this denomination in the total banknotes in circulation was very high, in terms of value they constituted a very small percentage, cost of printing of this deno was high and re issues not commensurate with their life, further printing and fresh issues of these banknotes has been discontinued.

Bank notes to the extent of only 4255^^ million pieces (8.51 billion rupees) of Rs 2/- denomination are in circulation in the year 2012-2013 which works out to 3.93 % of the total notes issued in 43 years (^^Ref:- Database on Indian Economy/ RBI Data Warehouse: Table 159 : Notes and Coins Issued).

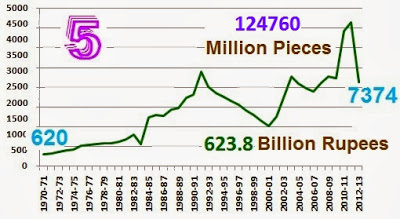

printed and issued in a span of 43 years i.e from 1970 to 2013. The

second graph (volume in million pieces) shows the same

trend of issue/ circulation every 10 years

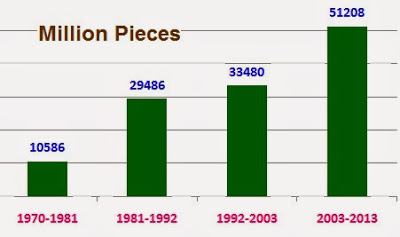

As for Rs 5 /- denomination whose printing has also been discontinued from the year 2005, the total quantum issued/circulated in 43 years (1970-2013) have been 124760 million pieces of notes. If we keep the first 10 years issue figures as base, then the position of issue/circulation works out as below:

(i) Increase in the issue/circulation by nearly 2.9 times in the next 10 years i.e 1981-1992.

(ii) During 1992-2003 the issue/ circulation of this denomination increased by 13.5 % compared to 1984-94 issues.

(iii) Increase in the next ten years i.e 2003-2013 by 52 % compared to previous ten years.

Though the printing and fresh issue of this denomination though has been discontinued, it was re-introduced in 2001 for a short period to tide over the crisis of demand and supply of coins and issue once again discontinued from the year 2005. Whatever quantum is in circulation is still considered to be legal tender. It is presumed that the soiled currency in circulation is being slowly withdrawn and not issued again.

Bank notes to the extent of only 7374^^ million pieces (36.87 Billion rupees) of Rs 5/- denomination are in circulation in 2012-2013 which works out to nearly 6 % of the total notes issued in 43 years (^^Ref:- Database on Indian Economy/ RBI Data Warehouse: Table 159 : Notes and Coins Issued).

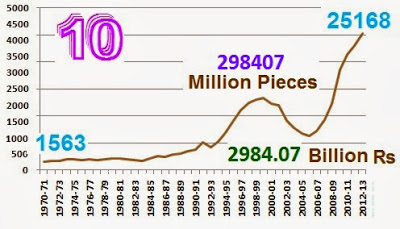

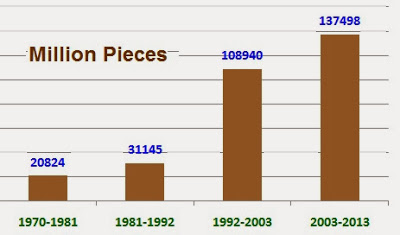

printed and issued in a span of 43 years i.e from 1970 to 2013. The

second graph (volume in million pieces) shows the same

trend of issue/ circulation every 10 years

As for Rs 10 /- denomination whose printing has also been discontinued and re introduced at intervals, the total pieces issued in 43 years (1970-2013) works out to 298407 million pieces of notes. If we keep the first 10 years issue figures as base, then the position of issue/circulation works out as below:

(i) Increase in the issue/circulation by nearly 1.5 times in the next 10 years i.e 1981-1992.

(ii) During 1992-2003 increase in issue/ circulation by 3.5 times compared to 1981-92 issues.

(iii) Increase in the next ten years i.e 2003-2013 by 26 % compared to previous ten years.

The printing and fresh issue of this denomination continues to be suspended and reprinted at long intervals to meet the shortages of bank notes in circulation. It is presumed that the soiled currency in circulation is being slowly withdrawn and not issued again.

Bank notes to the extent of only 25168^^million pieces ( 251.68 Billion rupees )of Rs 10/- denomination are in circulation in 2012-2013 which works out to 8.4 % of the total notes issued in 43 years. (^^Ref:- Database on Indian Economy/ RBI Data Warehouse: Table 159 : Notes and Coins Issued).

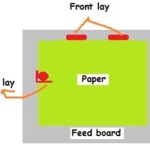

In view of ever increasing demand for the Bank Notes RBI has decided to introduce one Billion Polymer Notes in Rs 10/- deno in this year following their successful usage in Australia and Singapore to safeguard against counterfeiting of currency and to enforce clean note policy. Besides Australia and Singapore the other countries that use the Polymer notes are New Zealand, Papua New Guinea, Romania, Bermuda, Brunei and Vietnam etc. The Polymer notes are expected to have five times longer life than Paper currencies and enhanced safeguard against counterfeiting of currency. Read the following from RBI that explains the plan of action on the anvil:

-Quote:

”To increase the circulation life of banknotes, particularly in small denominations, the Reserve Bank, in consultation with Government of India, considered various options, including printing banknotes on plastic substrate. Accordingly, it has decided to introduce one billion pieces of 10 banknotes on plastic substrate for field trials in five cities, viz., Jaipur, Bhubaneswar, Kochi, Shimla and Mysore, which have been identified because of their geographic and climatic diversity they last longer; they create minimal dust and no fibers during printing and handling; and they can contain certain security features that are difficult and expensive to counterfeit”.

The Reserve Bank engaged the services of The Energy and Resources Institute (TERI) to conduct a study on the carbon footprint of cotton-based banknote paper substrate vi-à-vis plastic-based substrate and to estimate their overall environmental impact, taking into account their complete life cycles.

The Life Cycle Impact Assessment results for the two types of notes indicate that replacing cotton-based notes with plastic-based notes would have significant environmental benefits. Polymer/plastic banknotes (and the waste from production) can be granulated and recycled into useful plastic products such as compost bins, plumbing fittings and other household and industrial products. The base material of polymer is a non-renewable resource, but due to its recyclability, it has more than one life”. (Ref:- RBI Annual Report 2011-13 )

– Unquote

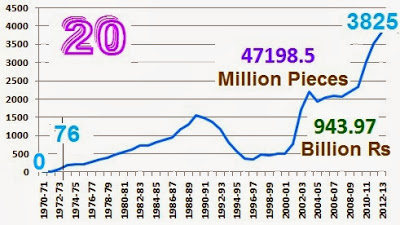

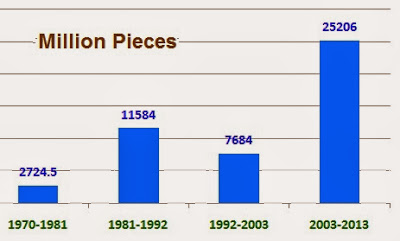

printed and issued in a span of 43 years i.e from 1970 to 2013. The

second graph (volume in million pieces) shows the same

trend of issue/ circulation every 10 years

As for Rs 20 /- denomination the total pieces issued in 43 years (1970-2013) have been 47198.5 million pieces of notes. If we keep the first 10 years issue figures as base, then the position of issue/circulation works out as below:

(i) Increase in the issue/circulation by nearly 4.2 times in the next 10 years i.e 1981-1992.

(ii) During 1992-2003 the issue/circulation decreased by 33 % times compared to 1981-92 issues.

(iii) In the next 10 years i.e 2003-2013, the issue/circulation saw steep increase in issue/ circulation by 300%.

Now in 2012-2013 Currencies of this denomination remains in circulation to the extent of only 3825^^million pieces works out to mere 8.1 % of the total notes issued/circulated in 43 years (^^Ref:- Database on Indian Economy/ RBI Data Warehouse: Table 159 : Notes and Coins Issued).

————————

{** Courtesy :- The Graphic representations shown for Rs 2/-, 5/-, 10/-, to Rs 20/- denominations have been prepared on the basis of the Data taken from RBI site:- ”Database on Indian Economy/ RBI Data Warehouse: Table 159 : Notes and Coins Issued” )

—————————-

Recent Comments