An analysis on Printing and circulation of Paper Money – 6

-Analysis-

One of the reports suggest that compared to the year 2000 when around 3500 million pieces of Bank Notes were targeted for withdrawal as unserviceable, it was estimated by the Committee that the withdrawal of unserviceable Bank Notes may go up by seven times during the year 2010.

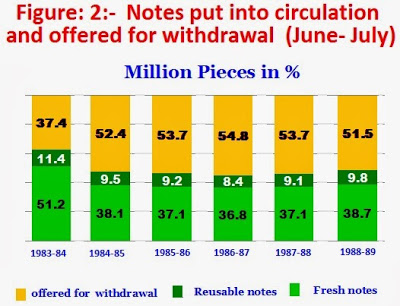

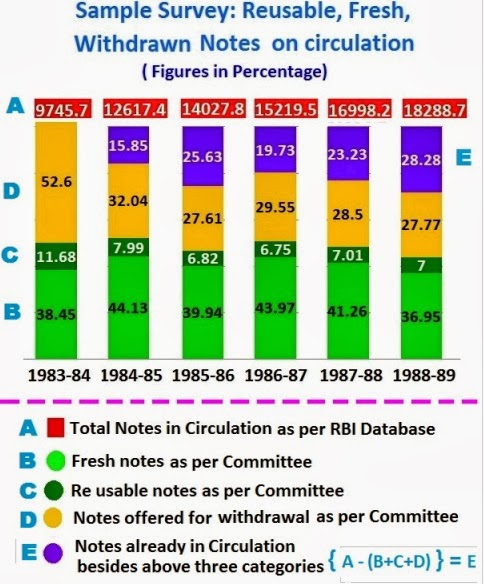

See below one sample data given in the ‘Report of the Committee on Currency Management’ to show the combination of Notes that were in circulation during the period 1983 till 1989. The data show that out of total Notes in circulation, 50 -60 % 0f the Notes came back for sorting out of which 10-12 % goes back into circulation as usable, while 80 % from the 50-60% notes that came back for sorting are withdrawn as unserviceable.

The Committee which recorded the above finding however has not indicated whether the notes offered for withdrawal have been actually withdrawn or re issued later. Therefore we presume that the quantum of Bank Notes shown in the report as offered for withdrawal may have been actually withdrawn from circulation. The above data reveal that every year almost 35-40 % of the Notes in circulation are of fresh Notes and hardly 10-11 % % is reissued from the salvaged notes (sorted as usable and unusable) .

This crucial factor (unserviceable Notes) which annually works out to an average of 25 % and fresh Notes infused on an average of 40% is also one of the factors considered while drafting the demand for printing of Bank Notes. Processing of huge quantum of Notes offered for withdrawal which is around 35 % annually as could be seen from the above data and hereto carried out by manual examination in RBI is an area that remains unpredictable while drafting out the annual printing requirement for Bank Notes since assessing the serviceable and unserviceable Notes by manual examination is not an easy task to carry out. Attempts are made by RBI to ensure that at least 50 % of the Notes in circulation are that of fresh Notes issued annually to increase the life of Notes in circulation.

One important point to be borne in mind on the issue of Paper Money and Coins is that the issuance of the Paper Money is carried out by RBI under Section 22 of the Reserve Bank of India Act, 1934 while the Govt which is responsible for the issue of the Coins does the function through RBI. The RBI does not independently and directly handle the Coinage issues.

In this issue one of the important observation made by another expert committee of RBI which compiled a report ”Modelling Currency Demand in India” need mention here which indirectly throws light as to why the Projection of printing requirement for Bank Notes remains difficult and often go wrong:

Quote:

Introduction : Para -8 :- Generally, the denominational structure of currency comprises 4 to 5 coin categories in the lower denomination and 5 to 6 note categories in the higher denomination. Considering that the lower denomination currencies are used for small value transactions, which account for a major part of the cash transactions, these denominations have a greater degree of velocity of circulation. This is why the lower denomination currencies are issued in the form of coins having a much longer life than notes. In the short and medium term, the structure of denominations may not undergo change and, therefore, the estimation problem essentially relates to determining the value and volume of requirement of the existing denominations. However, in the long term, the issues such as introduction of new higher denomination notes, discontinuance of low denomination coins and coinisation of lower denomination notes etc assume importance and require careful attention in keeping with the objective of managing the volume of currency in circulation…………. ( Ref: Modeling Currency Demand in India: An Empirical Study- by Development Research Group of RBI)

—-Unquote

Coming back to the issue of forecast and raising demand for printing of Bank Notes, as stated earlier, based on certain statistical data the Reserve Bank decides upon the volume and value of Bank Notes to be printed annually which again partly relies on the quantum of recovery from the Soiled notes. As per one of the documents presented in the Currency Conference held in the year 2002 in Honolulu, Hawaii, it has been indicated that the annual requirement of Bank Notes for RBI is 12000 Million pieces. However the fact is otherwise as will be discussed later.

Projection of Currency requirement will be a arduous task in a country like India where over 70 % of the population live in Villages and the labour force works out to be very strong in number that includes agricultural labourers to labourers of various nature in other industries. Most of them get their wages only in cash. They cannot be expected to get their transaction done through in card or other means except handling cash as the cash they get is hardly enough to carry on the family requirement. Moreover India being a orthodox country has many festive and marriage seasons that surface almost six to seven months in a year and only huge cash transaction takes place in every one of the occasions.

Hoarding of cash is another issue that rattles Indian economy. The price level and inflation is also becoming unpredictable mainly due to several unforeseen International activities such as crude oil prices which disturbs the economics which again indirectly influences the Money circulation.

As said earlier the other important aspect in deciding the demand- supply is the salvaging of the Soiled notes into usable and unusable notes to put them in circulation along with fresh notes besides weeding out the underground circulation of Counterfeit notes which gets mixed up with the genuine notes thwarting all idealistic calculations. It may be easier to project the production figures on Currency printing from the Presses and Supply line based on previous years statistics, but the demand being highly fluctuating factor, only 60-70 % success rate in projection can be can be achieved as indicated in previous Chapter .

Recent Comments