An analysis on Printing and circulation of Paper Money – 5

-Analysis-

Sometimes though the supply position of all denominational Bank Notes were on projected level, due to multiple reasons including hording of Currencies cause scarcity of some of the denominational Bank Notes. During such time people tend to use the next immediate Bank Note or equivalent Coins if available for their transactions. For example when enough Rs 50/- denomination notes are not available which may become necessary for certain specific cause, people may tend to use both Rs 10/- and Rs 20/- denominational notes in combination or singly to carry out the transaction. Whenever such crisis arise the demand for both lower denominational notes like Rs 10/- and Rs 20/- increases. Even though Rs 50/- notes may have been officially issued enough in volume as foreseen and indented, but may have disappeared in circulation due to unknown reasons which may be many, but in due course of time the suddenly horded Currencies may also reappear. Such scenarios also disturb the demand and supply position and mismatch with the calculations. On reasons for fluctuation in demand for the Currencies, the observations of the Expert Committee which submitted a report under ‘Modelling Currency Demand ‘ is :

Quote:

3: Currency Circulation in India – Aggregate Analysis : Among the important determinants of the demand for currency……………the following deserve special attention: (i) volume of transactions demand arising in the formal economy; (ii) transactions demand arising from the underground economy; (iii) precautionary, prudential and speculative demand; (iv) the type and pace of financial innovation and (v) use by other countries (in case of India, primarily Nepal and Bhutan)……………..

As regards the transactions demand for currency in the formal sector, it is expected that with the development of alternative modes of payment (cheques, electronic modes of payment), shift in the GDP composition from agriculture to services, spread of bank branches, and increased ATMs network reducing transaction costs, there would be a decline in the transactions demand for currency with the public, in relation to aggregate output (GDP)/private final consumption expenditure, and financial saving of households. On the other hand, progressive monetisation of the economy, reduced opportunity cost of holding currency with the secular decline in inflation, high taxation rates, wider ATM network rendering easy access to cash and increase in underground economy transactions would most likely lead to an increase in the transactions and hoarding demand for currency……………..

.(Ref :- Modelling Currency Demand in India: An Empirical Study /3 : Currency circulation in India- Aggregate Analysis )Unquote-

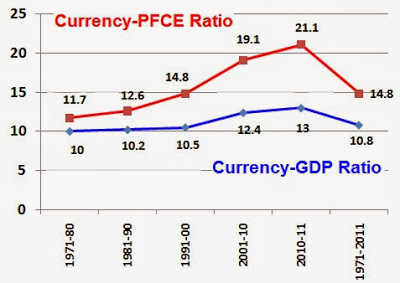

The demand for higher denominational Bank Notes arose in intervening years during the period 1970 to 2013 when inflation went up as the consumers in usual habit consumed much larger number of Currency Notes instead of transacting with cards. The Private Final Consumption Expenditure (PFCE) which in other words is individual handling more cash instead of using electronic media transactions or Card transactions has been going up every year. While the expenditure accounted to 11.5 % in the year 1970-71, it rose to 23.8 % in the year 2008-09. Two reasons could be attributed for this trend.

The Gross Domestic Product (GDP) is an aggregate measure of total economic growth for a country, expressed annually on percentage basis and it represents the market value of all goods and services produced during the period measured. The measure includes personal consumption, government spending, exports-imports, investment etc. GDP per capita is considered an indicator of a country’s standard of living. As GDP grows the money power increases, indirectly causing the Bank Notes circulation to increase as there are more investments both by individuals and industries which had temporarily for few years shelved their investment plans in an uncertain and often adverse policy environment decides to revive the investment into new ventures. This overall scenario leads to increased demand for Bank Notes.

Modelling Currency Demand in India:

An Empirical Study /3 – Currency circulation in India )

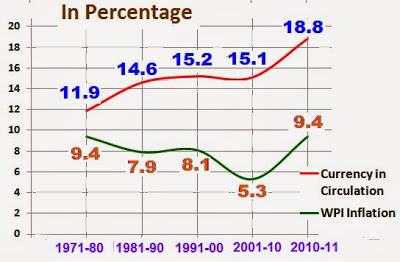

The other factor is Inflation Vs Currency circulation which is also in a way related to GDP. One may wonder whether the perception that ‘ the higher percentage of inflation’ leads to higher circulation of notes is actually true. Though it is general perception that inflation causes the prices to go up as a result of which more money is needed to conduct the day to day transactions, the other opinion is that continued high inflation causes decline in purchase power and goods and services becomes costly and therefore people tend to curb their expenditure when in such a situation the money circulation dwindles. Whichever view is correct one thing is certain that the extent of fluctuation in circulation of Bank Notes do not match with Inflation index as revealed in one of the survey results of the period 1971- 2011 which is shown below:-

Modelling Currency Demand in India: An Empirical Study

/4.1 Currency Denomination and Inflation: Implications for User of Currency)

It can be seen from the above graph that whenever the inflation went up, the circulation of Notes also went up, but not correspondingly, and whenever the inflation came down, the circulation of Notes did not come down even marginally. This would indicate that the higher inflation cause the circulation of Bank Notes to move upward, and is artificial and the circulation never drops down even when inflation comes down. Once the Notes put in circulation went up, they either continue to remain the same level or went up further except showing denominational variations over the years. This therefore is another worrisome factor that upsets forecast calculation of demand and supply of Bank Notes for circulation.

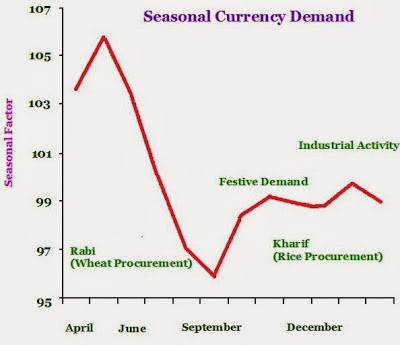

Currency is an important indicator of economic activity, especially in rural India. Cash demand tends to increase in the beginning of the month when salaries and wages are paid to different sects of personnel who keep spending them while the trend of spending tapers off at the end of the month. So is the seasonal demand of Currencies which by and large show the seasonality in economic activity. There has been seasonal fluctuations in circulation of Bank Notes every year. Preferences for certain denominations at specific periods and seasons which is totally unpredictable also influence the forecast of Demand-Supply of particular denominational Bank Notes. See below the trend of demand for Bank Notes which fluctuates in different seasons as compiled by a study group .

The issuing authorities of Bank Notes or Currencies determine the quantum of different denominations to carry out various transactions and the Currency composition of each for each of the succeeding financial years from the sample inputs derived from various banks and ATM transactions before formulating the the printing requirements. The same is the case in India too.

Recent Comments