INCOTERM- IMPORT/ EXPORT CONTRACTS

IMPORT/ EXPORT CONTRACTS

INCOTERMS

( Written by N. R. Jayaraman)

Every Supply order or Contract placed for the supply or import of Goods is covered by certain conditions vide the contracts. One of the conditions that govern the terms of supply is the delivery term. The mode of delivery, especially when goods are imported are governed by certain internationally accepted terms such as FOB, FAS, CIF and so on. What are the terms and why are they important ? That is spelled out in INCOTERM. How many of you know what is meant by INCOTERM ? INCOTERM is abbreviation of International Commercial terms. This term governs the Sales and Purchase practices, and form part of any standard Contract or Supply Orders. The INCOTERMS is revised every ten years and are internationally accepted terms which has been compiled in deference to the spirit of 1980 UN Convention on Contracts for International sale of goods. The latest has been published in the year 2010. The INCOTERMS are series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) widely used in international commercial transactions. Remember one thing before you read further. The INCOTERM is not law, but set of standard commercial practices adhered to around the world and when form part of the supply order or a contract it becomes a binding for both the parties and become basis for arbitration in cases of disputes.

Each term in INCOTERM specifies:

-

The obligations for services such as transport, import and export clearance, duty, documentation cost etc of the Supplier and the Buyer.

- The point of transportation from where the risk and cost transfers from the Seller to the Buyer

So by understanding the INCOTERM and properly incorporating it into the Supply Orders or Contracts , both the Seller and the Buyer will be relieved of unnecessary disputes and litigation in the event of loss, damage or other mishap to the goods from the time of supply to the receipt of the goods.

The INCOTERM only interprets the terms of delivery and states the obligations of the Purchaser and the Supplier in respect of the goods procured. They apportion transportation costs and responsibilities associated with the delivery of goods between Buyers (importers) and Sellers (exporters) and reflect modern-day transportation practices. The INCOTERM rules are accepted by governments, legal authorities and practitioners worldwide for the interpretation of most commonly used terms in international trade. They are intended to reduce or remove altogether uncertainties arising from different interpretation of the rules in different countries.

The INCOTERM does not interfere with the specifications of the material in any manner. This term plays vital role when the goods are imported. One of the awkward position which can some time arise in the Contract relating to the importation of goods is the non-performance of the obligation of the Seller/Buyer due to export and import prohibition, unforeseen an unavoidable impediments beyond both of their control. The INCOTERM enable the parties to understand the meaning of key words like FCA, FOB and CIF terms which are commonly used in any contract. Once both the parties understand the terms and its implication, there would be no misunderstanding.

How does the INCOTERM help the purchaser and the Seller? In case of the loss of the Goods, theft , damage during transit , it will be easy to claim the insurance, Customs or excise duties levied etc.

The INCOTERM only interprets the terms of delivery and states the obligations of the Purchaser and the Supplier in respect of the goods procured. They apportion transportation costs and responsibilities associated with the delivery of goods between Buyers (importers) and Sellers (exporters) and reflect modern-day transportation practices. The INCOTERM rules are accepted by governments, legal authorities and practitioners worldwide for the interpretation of most commonly used terms in international trade. They are intended to reduce or remove altogether uncertainties arising from different interpretation of the rules in different countries.

The INCOTERM does not interfere with the specifications of the material in any manner. This term plays vital role when the goods are imported. One of the awkward position which can some time arise in the Contract relating to the importation of goods is the non-performance of the obligation of the Seller/Buyer due to export and import prohibition, unforeseen an unavoidable impediments beyond both of their control. The INCOTERM enable the parties to understand the meaning of key words like FCA, FOB and CIF terms which are commonly used in any contract. Once both the parties understand the terms and its implication, there would be no misunderstanding.

How does the INCOTERM help the purchaser and the Seller? In case of the loss of the Goods, theft , damage during transit , it will be easy to claim the insurance, Customs or excise duties levied etc.

The INCOTERM is divided into four groups such as :

1. GROUP ‘E’:

EXW – meaning Ex-works.

2. Group ‘F’:

(a) FCA – meaning free carrier.

(b) FAS – meaning free along side ship.

(c) FOB – meaning free on board

3. Group ‘C’:

(a) CFR – meaning cost and freight.

(b) CIF – meaning cost insurance and freight.

(c) CPT – meaning carriage paid to.

(d) CIP – meaning carriage and insurance paid to.

4. Group ‘D’:

(a) DAF – meaning delivered at frontier.

(b) DES – meaning delivered ex-ship.

(c) DEQ – meaning delivered ex-quay.

(d) DDU – meaning delivered duty unpaid.

(e) DDP – meaning delivered duty paid.

EXW – meaning Ex-works.

2. Group ‘F’:

(a) FCA – meaning free carrier.

(b) FAS – meaning free along side ship.

(c) FOB – meaning free on board

3. Group ‘C’:

(a) CFR – meaning cost and freight.

(b) CIF – meaning cost insurance and freight.

(c) CPT – meaning carriage paid to.

(d) CIP – meaning carriage and insurance paid to.

4. Group ‘D’:

(a) DAF – meaning delivered at frontier.

(b) DES – meaning delivered ex-ship.

(c) DEQ – meaning delivered ex-quay.

(d) DDU – meaning delivered duty unpaid.

(e) DDP – meaning delivered duty paid.

1. EXW (Ex-Works) :- Ex works in effect means the goods are taken possession by the Buyer at the doorstep of the Seller. This thus takes away all the responsibilities of the Seller from that point. However where the export order is placed, even though the Sellers liability ends at their door step, by contractual arrangement, the Seller takes the liability of freight worthy packing, and forwarding through appropriate carrier at the risks and additional cost of the Buyer provided this clause is agreed upon in the Contract even though the Seller is not obligated to do so. However clearing the goods for export and arranging the import license if needed lies with the Buyer who can authorize appropriate agencies to do the job. The Seller must give the Buyer sufficient notice as to when the goods can be made available at the agreed or chosen delivery point so that the Buyer can make preparations in time to take delivery after inspection.

2. FOB ( Free on Board) :- This is one of the most commonly used term for the supply of goods. The Seller clears the goods for export and delivers them in the named port of shipment from where the goods will be either shipped by some Vessel or carried by an Aircraft. All other costs including insurance and transportation involved from the point of shipment is born by the Buyer even if the Seller in the foreign country assists the Buyer in getting the job done through appropriate agencies by charging additional and actual cost involved for movement of men and material. Normally every country has authorized forwarding agencies for clearing the goods meant for Governmental organizations who can be contacted for undertaking the said job.

3. FCA ( Free Carrier) :- Free carrier means that the Seller delivers the goods, after clearing them for export. The goods are delivered at the Carrier nominated by the Buyer at a named place of shipment. The Seller must obtain at his own risk and expense any export license or any other official authorization required to carry out Customs formalities as may be necessary for the export of goods from the place of exportation and chooses the Carrier for shipment. The Seller is also not responsible for the insurance and the cost is borne by the Buyer. Once the goods are delivered to the Carrier, from that point all the costs are borne by the Buyer. The term may be used for all modes of transport including multimodal Transport to the point of named place.

4. FAS ( Free Alongside Ship) :- This term is used only for Sea Freight or inland waterway transport. In these transactions, the Buyer bears all the transportation costs and the risk of even loss of goods and therefore make necessary arrangements for proper insurance from the point of freight. FAS requires the Seller to clear goods for export. In the case of FAS Contracts, the Seller arranges to clear the Goods for export through the freight agencies which arrange for the insurance and transportation of goods to the placement of loading. They will however not bear the cost of even loading and from the said point and all the risks and cost including the cost of loading and insurance will be to the account of the Buyer only even though the forwarding agent may raise the bill and submit for payment.

2. FOB ( Free on Board) :- This is one of the most commonly used term for the supply of goods. The Seller clears the goods for export and delivers them in the named port of shipment from where the goods will be either shipped by some Vessel or carried by an Aircraft. All other costs including insurance and transportation involved from the point of shipment is born by the Buyer even if the Seller in the foreign country assists the Buyer in getting the job done through appropriate agencies by charging additional and actual cost involved for movement of men and material. Normally every country has authorized forwarding agencies for clearing the goods meant for Governmental organizations who can be contacted for undertaking the said job.

3. FCA ( Free Carrier) :- Free carrier means that the Seller delivers the goods, after clearing them for export. The goods are delivered at the Carrier nominated by the Buyer at a named place of shipment. The Seller must obtain at his own risk and expense any export license or any other official authorization required to carry out Customs formalities as may be necessary for the export of goods from the place of exportation and chooses the Carrier for shipment. The Seller is also not responsible for the insurance and the cost is borne by the Buyer. Once the goods are delivered to the Carrier, from that point all the costs are borne by the Buyer. The term may be used for all modes of transport including multimodal Transport to the point of named place.

4. FAS ( Free Alongside Ship) :- This term is used only for Sea Freight or inland waterway transport. In these transactions, the Buyer bears all the transportation costs and the risk of even loss of goods and therefore make necessary arrangements for proper insurance from the point of freight. FAS requires the Seller to clear goods for export. In the case of FAS Contracts, the Seller arranges to clear the Goods for export through the freight agencies which arrange for the insurance and transportation of goods to the placement of loading. They will however not bear the cost of even loading and from the said point and all the risks and cost including the cost of loading and insurance will be to the account of the Buyer only even though the forwarding agent may raise the bill and submit for payment.

5. CFR (Cost and Freight ):- This term applies to goods sent by Sea or Inland waterway transportation at suppliers place. The Seller is responsible to get goods from their factory to the port of destination. Port of destination is to be clearly specified in the contracts. For example it may be CFR Frankfurt, CFR Berlin and so on even if the Sellers factory is somewhere in Washington. Their responsibility ceases once the ship moves out of the rails as the concept of delivery is accomplished up to this point. The Seller pay for the costs of freight necessary to bring the goods to the named port of destination. The risk of loss or damage to the goods or any other additional costs due to events occurring due to natural calamities after the ship leaves the rail at the port of shipment is transferred from the seller to the Buyer. The seller is also responsible for the clearance of goods for export.

6. CIF (Cost, Insurance and Freight):- This term in all respects is similar to CFR, but in addition puts the responsibility of the Insurance on the Seller. But the Sellers Insurance is limited to the port of destination where the goods will be loaded. Also once the goods are loaded on to the ship the responsibility of the Seller ceases and gets transferred to the Buyer even if the ship has not moved out of the Rails.

7. CPT (Carriage Paid To) :- Most of the operative part in this transaction is similar to CIF. The risk of loss or damage to the goods, additional costs due to any other events occurring after the goods have been delivered to the carrier is transferred from the Seller to the Buyer when the goods have been delivered into the custody of the first carrier in multi modal transportation. The Seller pay for the costs of freight necessary to bring the goods to the named port of destination but is not responsible for procuring insurance. The term may be used for any mode of transport including multimodal transport by rail, road, sea, air, inland waterway or by a combination of such modes.

8. CIP (Carriage and Insurance Paid To):- This term is mainly meant for multimodal transportation of the goods. The Seller is responsible for the transportation costs associated with delivering goods and procuring minimum insurance coverage to the named place of destination.

9. DAF (Delivered At Frontier):- DAF means the Seller clears for export and delivers the goods at the disposal of the Buyer by any means of transport at the named point and piece at the frontier but before the Customs Border of the adjoining country. However the clearance from that point including that of import license etc is the responsibility of the Buyer. The Seller bear all the cost involved up to this point and thereafter once the goods are transferred into another transport the cost incurred will be to the account of the Buyer.

6. CIF (Cost, Insurance and Freight):- This term in all respects is similar to CFR, but in addition puts the responsibility of the Insurance on the Seller. But the Sellers Insurance is limited to the port of destination where the goods will be loaded. Also once the goods are loaded on to the ship the responsibility of the Seller ceases and gets transferred to the Buyer even if the ship has not moved out of the Rails.

7. CPT (Carriage Paid To) :- Most of the operative part in this transaction is similar to CIF. The risk of loss or damage to the goods, additional costs due to any other events occurring after the goods have been delivered to the carrier is transferred from the Seller to the Buyer when the goods have been delivered into the custody of the first carrier in multi modal transportation. The Seller pay for the costs of freight necessary to bring the goods to the named port of destination but is not responsible for procuring insurance. The term may be used for any mode of transport including multimodal transport by rail, road, sea, air, inland waterway or by a combination of such modes.

8. CIP (Carriage and Insurance Paid To):- This term is mainly meant for multimodal transportation of the goods. The Seller is responsible for the transportation costs associated with delivering goods and procuring minimum insurance coverage to the named place of destination.

9. DAF (Delivered At Frontier):- DAF means the Seller clears for export and delivers the goods at the disposal of the Buyer by any means of transport at the named point and piece at the frontier but before the Customs Border of the adjoining country. However the clearance from that point including that of import license etc is the responsibility of the Buyer. The Seller bear all the cost involved up to this point and thereafter once the goods are transferred into another transport the cost incurred will be to the account of the Buyer.

10. DES (Delivered Ex Ship):- DES means the Seller delivers when the goods are placed at the disposal of the Buyer on board the Ship not cleared for import at the named Port of Destination. The term can be used only when the goods are to be delivered by sea or inland waterway or multi-model transport on a Vessel at the Port of Destination. The Seller must contract at his own expense for the carriage of goods to the named point at the named port of destination. The cost of the documents necessary for the importation will be on Buyer’s account.

11. DEQ (Delivered ex-quay):- Delivered Ex-quay means the Seller’s responsibility remains when the goods transported by sea or inland waterway is discharged from a vessel on to the quay (landing platform) at the named port of destination. The seller has to bear the costs and risks involved in bringing the goods to the named waft (landing platform) of destination even if it means multi modal transportation. The cost of documents will also be to the account of the Seller. This term can be used only when the goods are to be delivered on to the quay in the port of destination.

12. DDP (Delivered Duty Paid):- This term is used on the goods delivered on emergency basis or small goods delivered through Postal means or by Courier. The Seller is responsible for the delivery at the Buyers premises all charges including Duty paid based on a letter of intend based on faxed quotation. The Buyer will regularize the Contract later based on the faxed quotation. While Ex works terms represents the minimum obligation to the Seller, the Delivered duty paid term represents the maximum obligation to the Seller.

13. DDU (Delivered Duty Un Paid):- This term is used on the goods delivered on emergency basis or small goods delivered through Postal means or by Courier based on a letter of intend based on faxed quotation. However it is the duty of the Buyer to get the goods cleared from the Customs by payment of duty. The Buyer will regularize the Contract later based on the faxed quotation. The Buyer has to bear the responsibility for carrying out the Customs formalities, Customs duties, payment formalities and other charges involved for import in the country of destination.

11. DEQ (Delivered ex-quay):- Delivered Ex-quay means the Seller’s responsibility remains when the goods transported by sea or inland waterway is discharged from a vessel on to the quay (landing platform) at the named port of destination. The seller has to bear the costs and risks involved in bringing the goods to the named waft (landing platform) of destination even if it means multi modal transportation. The cost of documents will also be to the account of the Seller. This term can be used only when the goods are to be delivered on to the quay in the port of destination.

12. DDP (Delivered Duty Paid):- This term is used on the goods delivered on emergency basis or small goods delivered through Postal means or by Courier. The Seller is responsible for the delivery at the Buyers premises all charges including Duty paid based on a letter of intend based on faxed quotation. The Buyer will regularize the Contract later based on the faxed quotation. While Ex works terms represents the minimum obligation to the Seller, the Delivered duty paid term represents the maximum obligation to the Seller.

13. DDU (Delivered Duty Un Paid):- This term is used on the goods delivered on emergency basis or small goods delivered through Postal means or by Courier based on a letter of intend based on faxed quotation. However it is the duty of the Buyer to get the goods cleared from the Customs by payment of duty. The Buyer will regularize the Contract later based on the faxed quotation. The Buyer has to bear the responsibility for carrying out the Customs formalities, Customs duties, payment formalities and other charges involved for import in the country of destination.

The next important thing to be noted is the type of documents which may be required for importing the goods. They are:

1. Bill of Lading:- For sea freight or multi-modal transport. It is a transferable document allowing the Buyer to even sell the goods while in transit by transferring the documents at any rate.

2. Multi-mode transport document:- This document is meant when the goods are transported by at least two different modes of transport such as Air and Sea or Air and Road or Sea and Road etc.

3. Sea Way Bill: – Used for transit by sea and known by different names like nonnegotiable Bill of Lading, Cargo Key Receipt etc.

4. Mate’s Receipt:- Document providing proof of delivery to a carrier meant for Sea transit and given instead of Bill of Lading.

5. Airway Bill:- Meant for dispatching by air.

6. Consignment Note:- Meant for dispatch of goods by land.

7. Warehouse Warrant:- Transferable document used when goods are to be collected by the Buyer from the Warehouses.

8. Freight Forwarder’s Documents:- Document meant for goods dispatched by sea, air, land or multi- modal transport to identify whether the Forwarder has undertaken responsibility of the carriage.

2. Multi-mode transport document:- This document is meant when the goods are transported by at least two different modes of transport such as Air and Sea or Air and Road or Sea and Road etc.

3. Sea Way Bill: – Used for transit by sea and known by different names like nonnegotiable Bill of Lading, Cargo Key Receipt etc.

4. Mate’s Receipt:- Document providing proof of delivery to a carrier meant for Sea transit and given instead of Bill of Lading.

5. Airway Bill:- Meant for dispatching by air.

6. Consignment Note:- Meant for dispatch of goods by land.

7. Warehouse Warrant:- Transferable document used when goods are to be collected by the Buyer from the Warehouses.

8. Freight Forwarder’s Documents:- Document meant for goods dispatched by sea, air, land or multi- modal transport to identify whether the Forwarder has undertaken responsibility of the carriage.

9. Packing List.

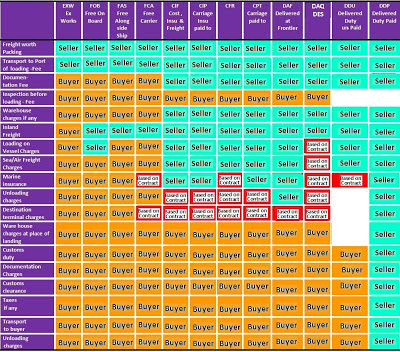

INCOTERM CHART

Recent Comments