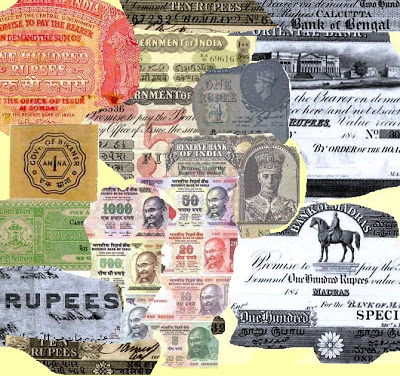

Origin and growth of

Bank Notes and Currencies – 4

(Written by N.R. Jayaraman)

Paper money traces its origins to the late 17th Century in India when the Paper Money was issued in limited scale by several private banks. The earliest form of note issued have been from private banks like Bank of Hindustan (operated from 1770-1832), General Bank of India, Bank of Behar (both operated from 1773-75), and the Bengal Bank (operated from 1784-91) etc.

From 15th Century to 17th Century metal Coins have been issued in the name of Rupees which should not be confused with Paper Money. Rupee probably is a word derived from Sanskrit which explains the word ‘Rupiah’ as a ‘stamped or image impressed metal coin’. In Sanskrit Silver is also referred as Rupa. Therefore the word Rupee in could have possibly emerged from this word Rupiah. May be rupees means several coins and that is the reason why when lowest valued note issued was referred as One rupee and the rest of the Paper Money as Two rupees, five rupees, ten rupees and so on.

While the printing and issue of the Currencies are linked to the Gold reserve of a country, neither the basis on which the Paper Money was issued by the then private banks nor the modus operandi of the transaction or to the extent to which the Paper Money were issued remain sketchy and unknown. However those Banks issued their own Paper Money based on mutual trust and good will of the trading community.

Among the early issuers of Paper Money was the General Bank of India , Bank of Behar and Bengal which were state sponsored institutions set up in participation with local expertise. Their Paper Money enjoyed government patronage. Though the usage was found successful, the General Bank of India was officially wound up and was short lived. The Bank of Hindostan (1770-1832) was set up by the agency house of Alexander and Company and was successful for some years. The Bank of Hindostan finally went under when its parent firm M/s Alexander and Co. failed on account of commercial crisis as official patronage and the acceptance of Paper Money in the payment of revenue was a very important factor in determining the circulation of bank Paper Money. Moreover the uncertainty in Europe on account of World War caused the failures of the Banks.

However the issue of Paper Money could not succeed as anticipated because of the fluctuation in the values of the metal. Most of the metallic Coins were in Copper and Silver weighing particular grammage. With demand and supply fluctuating, their value too fluctuated and this specific issue caused uncertainty in the value of the Paper Money which were issued against the particular value of Silver or Copper Coins that existed at the time of issuing the Paper Money. Since the Banks were obliged to issue equivalent quantity of metallic Coins in lieu of the Paper Money that guaranteed the payment, the messy situation caused economic crisis in the Banks on account of declining profits. Those issues were not anticipated in advance and the same lead to the crisis of issuing Paper Money thus leading the closure and merger of some of the Banks.

As for their circulation it appears that they were limited to only privileged set of users and was not transacted on a mass scale. The Currencies issued were also not resembling to that of a printed Currency of the modern era, but were more of a coupon indicating the value, the name of bank which issued it with some words in multi lingual and each bearing the signature of the one who had issued it. No design elements were added, no security features found, and no special paper like Watermark paper has also been reportedly used. They were issued on normal thick paper.

……….to be continued

Recent Comments