An analysis on Printing and circulation of Paper Money – 7

Circulation of Paper Money via-a-vise

Quantum of Paper Money

printed and processed

-Analysis-

-Analysis-

( Written by : N. R. Jayaraman)

– 7 –

The Expert Committee under the Chairmanship of the Dy. Governor of RBI which studied various aspects of Currency Management further indicated in ”Report of the Committee on Currency Management” certain factors which are primarily considered while working out the Printing requirement of Bank Notes.

Quote:-

The secular increase in currency is explained by a number of factors. The demand for currency arises from the increase in real income, the persistent inflation and the commercialization of the non-monetized sector. Currency expanded relentlessly in India over the last few decades…………..

………The very high rate of growth in currency requirement and the consequent stepping up of the production of fresh notes, though short of the needs, has increased the volume of notes passing through the Issue Offices to the currency chests. It has also led to a rising flood of notes offered for withdrawal from circulation, as being unfit for further use……. .( Ref : Chapter 2 / para 2.2)

……….. while notes in circulation more than doubled between 1980 and 1989, fresh notes supplied rose only by 20%. It has, therefore, become necessary to salvage even poor quality notes from the soiled notes returning to the currency chests and the RBI and reissue them to the public, though Section 27 of the Reserve Bank of India Act places a duty on the RBI to ensure that only reasonably clean notes are maintained in circulation…………

Annexure 2 of the report (which is shown below) also shows a significant reissue of salvaged notes, being about one-sixth of the issue of fresh notes during the period 1980-89. ( Ref : Chapter 2 / para 2.3)

Unquote:-

I have already pointed out in Chapter 5 vide graph ‘Seasonal Changes in Currency demand’, preferences for certain denominations at certain periods and seasons that influence the Demand-Supply of particular denominational Bank Notes. Sometimes though the supply position of all denominational Bank Notes are sufficiently issued as projected, multiple reasons like agricultural, festival and marriage seasons including hording creates artificial scarcity of Bank Notes temporarily. However when scarcity of such denominational Bank Notes arise, people tend to use the next available Bank Note or equivalent Coins for transactions.

For example when demand for more quantum of Rs 50/- denomination arise on account of certain specific reasons, on such stated occasions when enough Rs 50/- notes are not available, people may use both Rs 10/- and Rs 20/- denominational notes to compensate Rs 50/-. During such time the demand of both the lower denominational notes like Rs 10/- and Rs 20/- may suddenly increase even though Rs 50/- notes may have been officially issued enough in volume as foreseen and indented. Such artificially created crisis on account of horded Currencies may also suddenly disappear at times. Such scenarios also disturb the demand and supply position and upset calculations. If we study the Supply- Demand position of various denominations from 1970-71 to 2010-11 we can see that the denominational requirements were erratic and not uniform.

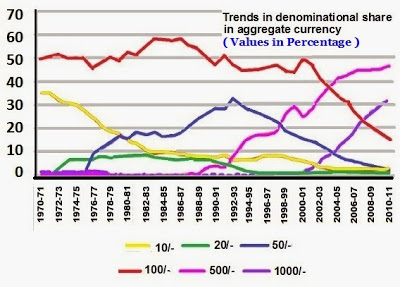

One of the Research paper from RBI – ”Modeling Currency Demand in India: An Empirical Study- by Development Research Group of RBI” showed the trend as shown below :

(Ref to Graph : Chart 4.1/ Trends in Denominational share in

aggregate Currency / Modelling Currency Demand in India:

An Empirical Study )

The above graphic representation reveal the following:

Quote—

*a) Throughout three decades i.e from 1970 to 1990 the Rs 100/- deno accounted to 50% of the value of the total Currency in circulation

*b) During the same decade from 1970 to 1990 when Rs 500 and Rs 1000 deno were introduced the use of Rs 100/- deno declined to 14.8 per cent in 2010-11.

*c) The demand of Rs 10/- deno which was almost around 34.3 per cent in 1970-71 declined to 2.2 per cent by the year 2010-11.

*d) Similarly the demand for Rs 20/- denomination notes when introduced was almost around 8 per cent during 1982-83 and the demand went down to 0.6 per cent by 2010-11.

*e) During 1980-90 the demand for Rs 50/- deno was 32.1 % and went down to 1.7 % in 2010-11

*f) Rs 500/- denomination which became the important denomination since 1998-99 accounted to 47 % in share value in the year 2010-11.

*g) Rs 1000/- which came to prominence during 2007-08 steeped to 27.8 % in share value in the year 2008-09

( *Excerpts from ‘4: Currency in circulation -Denomination wise analysis’ explaining the trend in graph as shown above)

Unquote—

Few Countries belonging to Organization for Economic Co-operation and Development (OECD) group conducted a study to analyze the demand pattern for various denominations in their Countries. They analyzed the demand pattern of various denominational Currencies from different Countries represented by them to conclude that in most of the Countries the demand for only those denominational Currencies dispensed by ATMs was far less than other denominational Currencies handled in direct Bank transactions. Why such a behavioral pattern existed could not be explained by them. Since they could not assess the reason for the said trend it gives a confusing picture to analysts like us who wonder whether such an act of public behavioral pattern indicate that whenever the public directly transacted with the bank, denominational Currencies other than those dispensed by ATMs were only drawn by them and they drew the other denominational Currencies from ATMs ? Since most of the ATMs in those OECD countries transacted medium valued Currencies and high value Currencies were handled in direct transactions in Banks, consumers were not eager to draw lower or medium denominational Currencies ?? It is difficult to understand.

…………….continued : 8

Recent Comments