An analysis on Printing and circulation of Paper Money – 8

-Analysis-

Even very recently the author noticed that a big lot of migrated Nepali workmen and labourers carried huge cash with them ( their income kept with some chit funds ) whenever they returned back to their native places. They said that the only Indian bank that transacted transfer of Indian money to Nepal was State Bank of India, which charged hefty transfer charges with several formalities involved! Therefore they avoid bank transfer of money. The reason to quote this information is to indicate that the growth in demand pattern of Bank Notes could have been higher in India due such of such several factors.

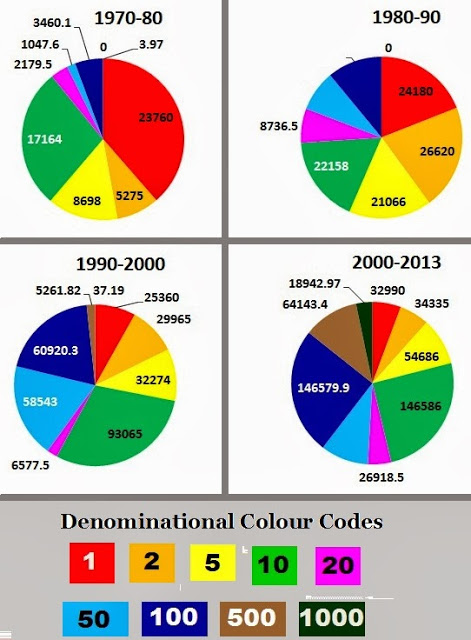

Demand for Rs 100/- and Rs 500/- has been on upswing reducing the handling of Rs 50/- denomination and preferred by salary earners, medium level traders and consumers at large, especially in urban areas. Rs 1000/- denomination is slowly catching up during 2000-1013 when more and more ATMs were put in use and much of the ATMs dispenses more of Rs 500/- and Rs 1000/- denominational Notes. Very few ATMs dispenses Rs 100/- denominational Notes. The overall picture indicates that the combination of Rs 10/-, Rs 100/- and Rs 500/- denominations are preferred by consumers in general more than other denominations.

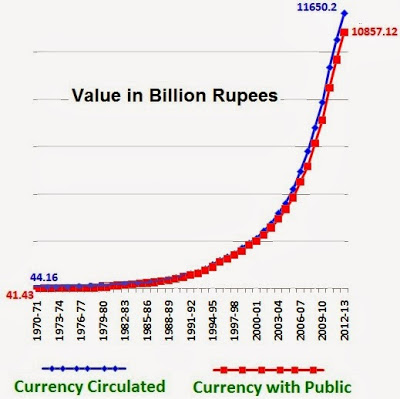

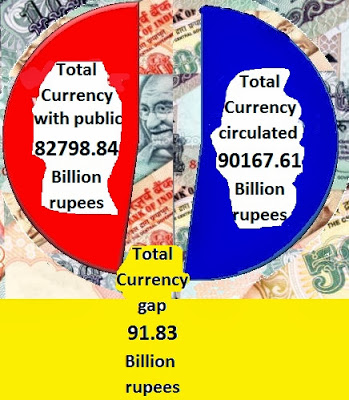

Another interesting factor to be noted is how much money is held by the public out of the circulated Notes? When we compare the Notes issued/ circulated from 1970-71 to 2012-13 along with the data on Currency with the Public, it is evident that nearly 7 % to 9 % gap exist between circulated Notes and Notes with public. From 1970 to 2013 the total quantum of Notes circulated was 90167.66 billion rupees while the Currencies with public was 82798.84 billion rupees. This further strengthens the view that more liquid Cash in the form of Bank Notes are needed in a vast Country like India.

Recent Comments