Written by : N.R. Jayaraman

Cash remains the predominant retail payment system all around the world even as cashless transactions are also increasing slowly. Since cash remains readily usable anywhere, anytime and offers high level of convenience, the need to scrutinize and segregate deposits of Bank Notes and Currencies into fit and unfit category, simultaneously weed out the counterfeited notes from the bundles to meet the ever increasing demand of hard cash for transactions remains the top agenda of the issuing banks.

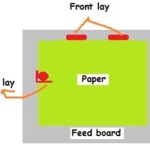

There is no denial to the fact that once issued to public, the quality of the currencies continue to deteriorate at faster pace due to the frequency of usage and the manner in which they are handled. In most of the countries, the Currencies and Bank Notes are handled casually by public, not everyone use wallets to keep the currencies fairly in good condition, not even traders keep them well stacked. A third of the currencies and bank notes that are put to circulation deteriorate in a short spell of time and therefore it has become the standard policy of the Central Banks to recirculate only the fit notes for public consumption retaining the currencies that have lost their useful life from the the deposited lots. The exercise of determining the deteriorated or unfit currency notes and replace them with new sets of currencies to maintain the quality of currency in circulation is done by manual checking process by the issuing branches.

In order to maintain the prescribed level of quality in currencies that are put to circulation, the banks resort to the exercise of periodically withdrawing deteriorated currencies and replace them with fresh currencies. In addition further currency is also put to circulation to meet the increasing market demand, all done in certain ratio, even as sufficient buffer stocks of Bank Notes and Currencies are got printed by the issuing central banks in the Security Printing presses.

What parameters determine the clean note policy? A Currency notes is considered fit for further circulation provided it meets the following criteria:

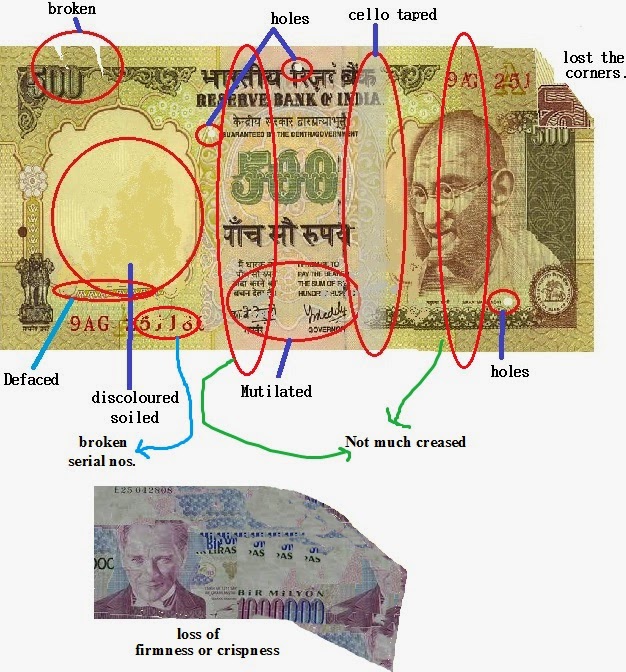

- That the notes are not soiled.

- Design elements not excessively faded, discolored or currency remain limp or firmness. Limp refers to the loss of firmness or crispness of the currencies while handling.

- Not too much creased or contains too many folds that will break that area.

- Not cracked nor lost the corners.

- No glaring holes due to stitching or stapling by users.

- No broken serial nos.

- Currencies with no defaced drawings, words, numbers, signs, symbols or where the serial number, imprint year, Governor signature, value of the currency, or any feature of the note has been altered in significant manner.

- Security threads damaged.

- Mutilated in any manner and two pieces joined by cello tapes.

Bigger challenge before the central banks is to decide whether circulated bank notes received back in deposits are still suitable for recirculation, whether the deteriorated currencies are to be destroyed and replaced by new ones. This again rests on the manual examination process to effectively sort out and weed out the forged currencies suitably. The longer use of banknotes reduces the cost of printing and prevent environmental pollution. Given the huge amounts of currencies and bank notes in circulation, determining the fitness of banknotes or currencies will have to be done with due consideration in manual examination process not only to reduce the cost of printing new currencies, but also to reduce the impact on environmental pollution due to destruction of currencies in several ways, one amongst them being burning by incineration.

The currencies continued to be still largely counted and examined manually to determine fitness criteria in most of the presses and banks. The inspection of currencies and bank notes being labour oriented, every note on every sheet is examined manually in the presses before processing into finished currency and similarly in the Central Banks and their branches the finished notes and currencies issued or deposited back are also examined manually to carefully determine fit, unfit criteria and weed out counterfeit currencies based on broad parameters listed above.

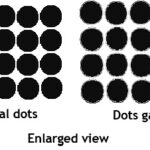

One would certainly agree where criticality in examining is required, the manual inspection can not be foolproof. Where every note or sheet is inspected manually, the examination can be done only with certain amount of subjectivity which varies from person to person as the defect which may appear to be minor to one may be acceptable to the other as tolerance limits can not be explained for visual inspection, that too in areas where microscopic look may be required to determine fit currencies. If haphazardly done such issues invite litigation and dispute. Therefore uniformity can not be maintained in manual examination where criticality is required.

Besides the tolerance limits which can not be explained for visual inspection, the limitation of time involved in the manual sorting process is another hurdle that needs to be considered. With the advent of more and more visible and invisible sophisticated security features incorporated in the currencies, criticality in examination and time factor apart, the aspect of cost effectiveness too needs to be addressed.

Therefore automation to take away subjectivity factor and reduce the time involved in manual process became necessary in the field of examination of currencies, and rightly several systems/machines with new generation detectors and sensors have been developed to ensure faster and objective scrutiny of printed currencies and sheets for use both in the presses printing currencies and in the Central banking sectors and units working under them who issue the finished currencies for public consumption.

Over a decade or so many automatic inspection machines have been developed by some of the leading players in the field of processing systems for Notes or Currencies. Interestingly not only the presses that print the currencies and the issuing banks that issue the finished currencies to public face the problem of objective sorting and issue, in a step further there remain several other areas like Malls, Super markets, Casinos and Gambling dens where ever increasing lots mixed with several denominational values of currencies including countries of other countries too need to be quickly sorted and issued again and again weeding out counterfeited currencies if any found mixed in them. Across the world, many of the Malls, Super markets, Casinos and Gambling dens accept universally acceptable currency with appropriate exchange rates and therefore in those areas too the mixed lots of currencies need to be effectively sorted out appropriately.

Even many of the collection centers receive mixed bags of currencies across the counters or in the deposit boxes. They have to be quickly and effectively sorted. In respect of issuing bank branches, they too receive bagful of currencies which need to be sorted to identify the fit /unfit currencies. All these factors will reveal that inspection and sorting of defect free currencies alone is not sufficient, but also the machines that are put to use for inspection and sorting need to address the additional problem of separating the mixed currencies appropriately from the lots. Realizing the magnitude of the problem, the suppliers have moved a step forward to develop processing machines that sort, determine fit/unfit currencies, but also sort out the currencies into various denominational values, various currencies etc drastically reducing the time involved in such exercises if done by manual labour.

Even though automation in sorting the multiple currencies into various denominational values, various currencies etc cannot be expected to be 100 % accurate, but contested by the suppliers who assure 100 % accuracy, the general feeling is that there will be an error margin of at least 2 % in view of several security features incorporated in each of the currencies which needs to be quickly scanned and compared in memory with the machines for sorting. However in respect of single country currencies the effectiveness of inspection cum sorting machine to process the currencies into fit/unfit Currencies have been highly successful.

Perfection in Bank note processing machines led to designing suitable table top model to heavy duty machines some suitable for the Presses and some for the Central Banks and their branches. Though at the outset it may appear simple, remember all operations to be carried out like comparing the currencies with memorized images and then sort, count, pack, reject destroyed etc all to be carried out at high speeds by a single machine is not an easy task to do accomplish. The case assumes more importance especially where sorting for the currencies packed in ATM as ATM fit and ATM unfit is involved. Amazingly all these operations have been made possible in the specialized machines developed by leading players in the supply of such machines.

The basic function of the sorting machines or processing systems is:-

- Rapid sorting and accounting of mixed denominations or various other Currencies and accounting them separately.

- Fitness sorting so that the usable and unusable deno including the counterfeited notes are identified and weeded out in separate trays.

- Withdrawal of expired series in separate stack.

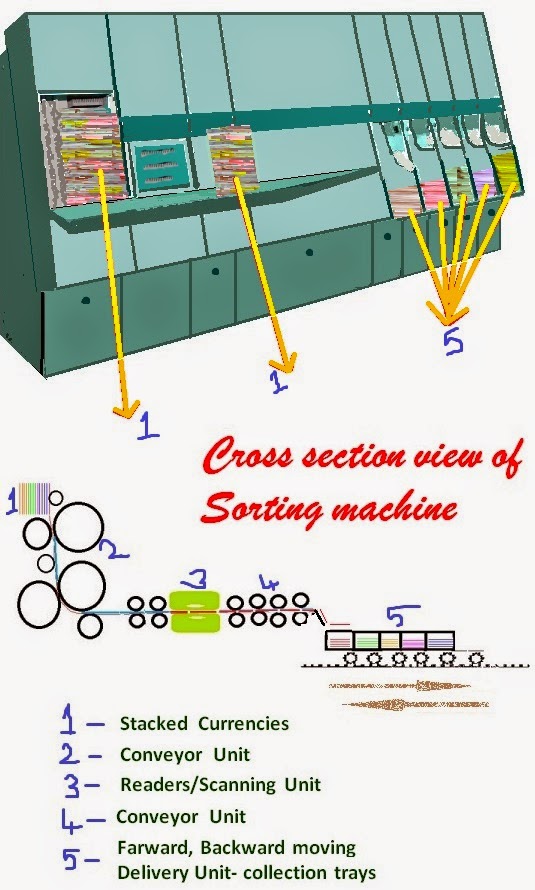

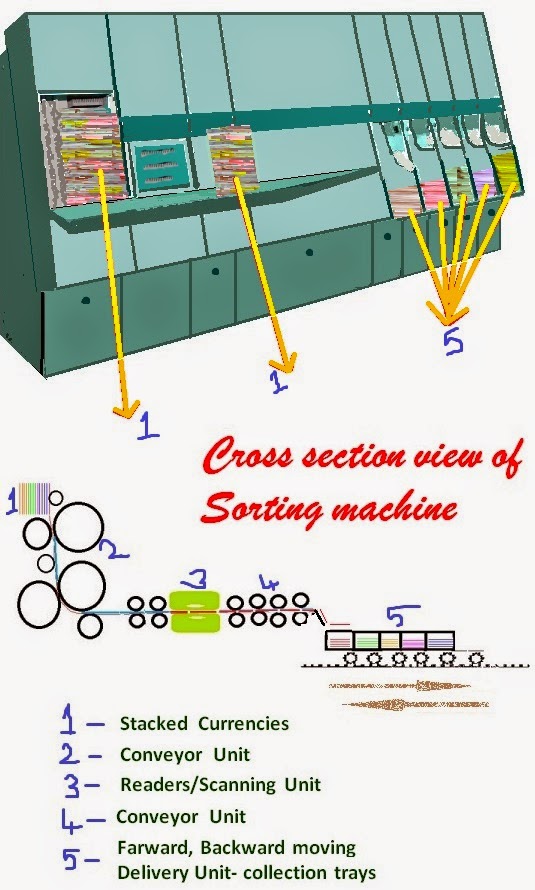

The Bank Notes or Currencies processing machine consists of plurality of sensors, a transport system, an input/output device, a control device and an interface. The control device has memory console that has the entire elements of bank note or currencies and during processing the data is compared through a software to sort out fit/unfit currencies or bank notes. The interface has couple of memory systems to keep features of different kinds of bank notes or currencies and which can be updated with alteration, supplementation or replacement of the data stored in the memory.

The heavy duty and most sophisticated ones have been marketed by eminent players like Giesecke and Devrient, De la Rue Giori and Japanese firm Toshiba etc. Even the small players like Kores India have produced smaller version for use in Banking sector and RBI in collaboration with a firm in Switzerland.

De La Rue Giori, pioneers in the field of manufacturing of several printing and processing machines for security printing and whose company installed the world’s first Automated Teller Machine (ATM) at Barclays Bank, in London, in the year 1967, claim to provide a range of high-speed cash sorting and authentication systems, enterprise cash management software and single note inspection equipment for banknote printing facilities, ensuring optimum productivity and performance for banking sector. The DLR 9000 processing machine offered by De La Rue claims meet the needs of banknote print works for end-of-line inspection and processing of fully-printed banknotes, guaranteeing the quality of currency.

One of the processing machines introduced by Giesecke Devrient (Giesecke & Devrient GmbH, Munich, Germany/ www.gi-de.com) has been Numeron® which according to the manufacturers have installed base of over 10,000 systems. The machine reportedly processes many different Bank note qualities and substrates including Polyester and hybrid paper. The speed of the machine is 1200 bank notes per minute and mainly intended for use in Central banks, Casinos and Commercial banks. It has integrated printer to get statistical reports. The machine rapidly sorts out mixed deposits including fit and unfit sorting.

The second model has been BPS®C4, which is most suitable for Cash Centers, Casinos and other areas where cash inflow is very high. BPS® C4 reportedly supports as many as 100 different Currencies, from Paper to Polymer base, but limited to 20 Currencies at a time as the output compartments are limited to 20 on this machine. The BPS®C4 enables uninterrupted operation even when Currencies are fed continuously that scans both sides of the Currencies with an excellent degree of authentication to sort, account and detect even counterfeits with high degree of high-tech sensor system with intelligent interface guides. It keeps accurate accounting even after jam recovery of the machines and the speed of the machine has been 40,000 notes/currencies per hour. The other models supplied by them include BPS X9 which processes 1,50,000 currencies per hour, the fastest processing system in the world of note sorters.

The third of the manufacturer is Toshiba (Toshiba Corporation, Minalto-Ku, Tokyo*) which is providing solutions for cash handling businesses to central banks, commercial banks, cash in transit(CIT), and security printing works.

*{http://www.toshiba.co.jp/sis/en/scd/bank/fs.htm#s1)}

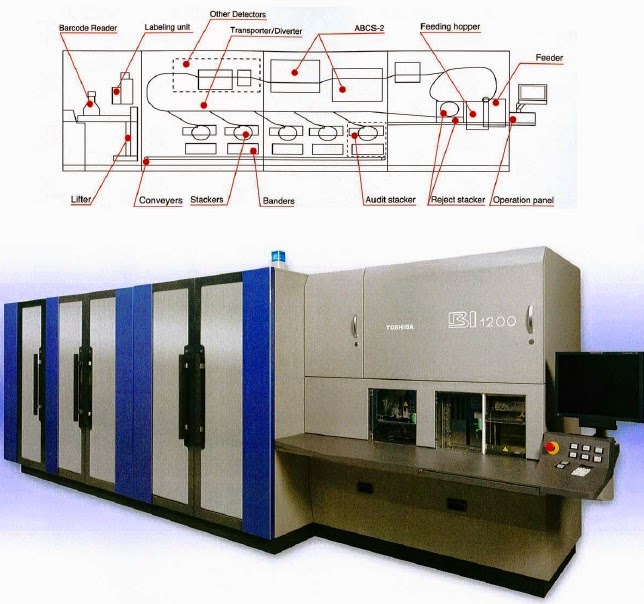

Their offer for Bank Note Processing machines for sorting and inspection under FS series is stated to be suitable for central banks and large commercial banks with a highly efficient system that uses advanced detectors to make fitness sorting of banknotes. Toshiba’s FS 2000 model offers multi denominational processing with a speed of 1,20,000 notes per hour. The model GB-5600 has been developed for banknote processing at central bank cash centers with a speed of 60,000 notes per hour. It has 4 stacker and 4 strapping units and model FS-810 with a speed of 40, 000 notes per hour with 4 stacks has been developed especially for branches of central banks. The firm is also offering IBS-1000 which is a compact desktop currency sorter. The heavy duty quality inspection system is also supplied by Toshiba under the series BI 1200.

- FS 2000

- GB 5600 and FS -810

- BI 1200

The latest in this field has been Kores India Limited. According to Kores India, their product Kores® Fusion Loose Currency Counting Machine Cum Counterfeit Currency Detector is a compact loose note counter table top machine that identifies counterfeit notes across the counter through various detection methods like Infrared Pattern Detection, Water Mark Recognition, Magnetic Detection, Security Thread Detection, Ultra Violet detection & overall printing detection through a stored/scanned image of the genuine note stored in the machine. Kores Fusion is manufactured in Switzerland.

According to Kores, the features include :-

- Capability to count 1500 notes per minute. During counterfeit detection, it runs at a speed of 1200 notes per minute.

- It also has an inbuilt capability of counting the value of the notes to make it easier for the Teller Guy/Cashier (in banks) to tally the slips while accepting it from the customer.

- Besides Indian Rupees (Rs.10, Rs.20, Rs.50, Rs.100. Rs.500 & Rs.1000 denomination), Kores Fusion can also be used for currencies of other countries like US Dollar, Great Britain Pound & Euro.

- At a time the currency of 16 countries can be programmed in Kores Fusion.

- Any new feature added in the currencies can be upgraded in the golden image stored for comparison.

- Notes of different denominations can be counted and checked in one go with Kores Fusion. While it will give you the total value of all the notes, Kores Fusion will also tell you how many notes are there of each denomination in the cluster.

Bank Innovation Systems shortly known as BIS (Belinski str. 163V, 620089 Yekaterinburg, Russian Federation) established in 2006 by a group of engineers, managers, and process specialists who had been working successfully in the field of bank process automation for 15 years in close cooperation with several international banknote printing factories has reportedly designed a machine called BARS 6000 for quality inspection of newly printed single notes, to deliver the standard bundle or package size containing 1000 notes and processes up to 40,000 notes per hour. The other models of sorting cum inspection machine offed by them include the following:

- Bars 6000

- Bars 5600

- Bars 5200

- Bars 3000

A firm in Ireland namely Dualtron Ltd offers Magner 175 model table top sorter for segregating fit/ unfit currencies and the machine is reportedly approved by ECB (European Central Bank). The firm claims that their machine is ECB Approved for Banknote Recycling Framework and has the following features.

- Two Pocket Banknote Fitness sorter

- Counts and separates ECB Fit notes from Unfit notes

- Very productive note sorter (800 notes per minute in Fitness Mode)

- Very quiet operation

- Counts notes in all conditions extremely accurately

- Count, ECB Fit, ATM Fit, Serial number detection option

- High Quality currency counter Made in Korea

The policy of ECB in respect of recirculation of clean note policy using machines for inspection and sorting of fit/unfit currencies are very clear. They have a testing mechanism for recognizing the devices suitable for sorting the Euro notes. Each device is tested by an NCB, in accordance with a common Euro system procedure, to check its ability to correctly detect counterfeit euro banknotes and to correctly identify genuine euro banknotes. Read the following ** :-

Quote:- The ECB is the central bank for Europe’s single currency, the euro. The ECB’s main task is to maintain the euro’s purchasing power and thus price stability in the euro area. The euro area comprises the 19 European Union countries that have introduced the euro since 1999. On 16 September 2010 the Governing Council of the European Central Bank (ECB) adopted Decision ECB/2010/14 on the authenticity and fitness checking and recirculation of euro banknotes. Decision ECB/2010/14 has been amended to extend its scope to the authenticity and fitness checking and recirculation of new series of euro banknotes. According to this Decision, euro banknotes may only be recirculated if they have been checked for authenticity and fitness. Euro banknotes recirculated via customer-operated machines or cash dispensers must be checked for authenticity and fitness by a type of banknote handling machine that has been successfully tested by a Euro system national central bank (NCB) -Unquote

Recent Comments