Chronicle of Money in India

….Barter, Metallic coins, Leather

currencies to Paper currencies….

(Extract from the lecture given by : N.R. Jayaraman)

3) Before Christ was born, every block of 1000 years were called millennium and when classic age began after Christ was born, every block of 100 years have been called century. Therefore whenever use of money in different periods of time is referred in millenniums, remember the period is well beyond 1000 years from now. 4) Since majority of common people in India live in Villages, they prefer transacting with liquid cash such as paper money and coins instead of debit/credit cards, as liquid cash is instantly and easily transactable. The trend is not uncommon even in cities where middle class people live more in number. The common villagers prefer the use of hard cash especially during seasons like Kharif and Rabi crop seasons besides festive seasons for payment of wages and other purchases. This is one of the periods when transacting with liquid cash is found to be higher. 5) The birth and growth of money in the form of Paper Currencies and Bank Notes stemmed from the primitive barter, a system through which goods in need were exchanged for other goods since no payment system in the form of money was in vague anywhere in the world millenniums ago. Medium of money in indirect forms like animals, food grains, shells, cowries, leather, metal and paper were used for trading purposes beginning from 2nd millennium. 6) In 10000 BC and later the most popular form of barter was exchange of live stocks such as Ox, Cow, and Goat, Sheep etc i.e animals to animals were transacted followed by agricultural products such as grains, vegetable or other plants. Thereafter anything was exchanged for anything. As time passed, food grains replaced animals in barter due to the difficulties encountered in transporting heavy loads of live stocks of animals from faraway places and therefore people began to feel that such heavier stocks could be exchanged locally against heavier stocks while the unavailable food grains in their region could be procured and brought from faraway places in exchange of food grains needed for each other. 7) In the next few centuries gradually rare pieces of expensive shells and cowries, considered to be treasured items all over the world in the ancient period replaced all other items like animals and food grains in barter, and began to be used as medium for transacting the business in Asiatic region in particular as they were available plenty in China and India.

8) During Stone Age say between 10000 BC to 3000 BC, only tribes constituted the population all over the world and their standard of living was almost identical everywhere and as the civilization began to dawn on them, gradually they learnt the art of making tools from stones, cultivated food grains and made essential articles for daily use such as clay pots etc to meet their requirement and to suit the atmosphere in which they lived. Whatever one group made, they were exchanged with other group from whom goods in need were procured. Still it was goods to goods and money did not emerge. This laid the foundation for organised trading of goods in later centuries.

10) As time elapsed, in about 1500 years ago, in transition from live stocks and food grains, some of the metals represented the stored value of goods for exchange in place of shells and cowries. In the history of money, only during this transition period, the concept of something like money emerged for transacting the business as each metal had their own discreet values depending upon their availability. Though metals came to be used as precious material for barter, still metallic coins did not surface but people began to recognize difference in the metals, their worthiness and availability and accordingly transacted the exchange with metals as medium without assigning any specific value to them in terms of money as valuating in terms of money also did not emerge then. 11) Again as time elapsed, people began to evaluate the value of metal used for exchange by various factors such as their availability, end use, durability and strength in end use. For example strong weapons were made with Iron, bronze and steel, utensils easier to handle and suited for making food items like copper and steel and ornaments with silver and gold etc. Those factors emerged slowly and steadily based on their experiences. 12) Beginning from 2nd millennium, money in the form of metal was used in different forms in different periods of time. Metals like Iron, bronze, Copper, Silver and Gold replaced other goods like animals, food grains, shells and cowries in stages for exchanges as weapons made of metals instead of on stones, some kind of crude ornaments and household potteries began to be developed. Gradually transaction of animals, food grains, cowries etc began to go to the background and metals began to emerge the major medium of exchange as money. Thus metals came into the forefront for exchange. 13) As the trend continued various materials were used as indirect form of money for sale and purchase. It was in Mesopotamia ( It is a Greek word meaning land between two rivers)civilization in 3500 BC that use of metal bronze first appeared. Ancient Mesopotamia is the most influential civilization and first known in world history, which was instrumental in bringing metals into money form, the beginning of banking system and some sort of written record began to be developed. 14) Mesopotamia is a name for the area of the Tigris–Euphrates river system, roughly corresponding to present day countries like Iraq, Syria and Kuwait including regions along the Turkish-Syrian and Iran–Iraq borders. 15) The historians say that in the Mesopotamia civilization, trade was based on a regulated system of exchange of metal against goods by written law i.e. a given amount of food grain or seed would be worth so many ounces of Silver or bronze or Gold for example. Therefore when someone had to make small payment for purchase of an item, they would cut the Silver or Gold bar available with them into pieces with appropriate weight and exchanged them. The nonstandard, crude shaped metallic pieces played the role of invisible form of coins or paper currency. Since the metals came to be exchanged as form of money, the merchants and traders kept the Gold and Silver bars safely in tall towers in the places of worship as if the metals were coins and currencies and the places of worship were banks to store the money in safe custody. 16) Still even with such kind of transactions, the perfect form of money did not emerge, but one has to agree that only such acts laid foundation for the concept of money to emerge several centuries later.

20) Though in early part of the 3rd century metallic money in the form of Gold bars have been used in some parts of Egypt for trading, between 4th and 6th centuries in Gupta dynasty the metallic money was used in Asiatic region. It was also surprising to note that bimetallic coins consisting of Silver plus Copper have also been issued during the ensuing period. 21) The word ‘Coin’ is derived from the Latin word ‘cuneus’ and as per some of the Numismatics, the first recorded use of coins was reported in China and Greece in around 700 BC whereas, it was reportedly prevalent in 600 B.C. in India too.

22) It is also interesting to note that organised form of coinage developed in India in the early period of 6th century BC, only after the arrival of the British settlers.

23) Along with the use of metallic money, paper money in indirect form surfaced in China assigning certain value to each of the paper money issued for ease in exchanges while trading. The indirect form of paper money was not printed currencies with designs and emblem embedded over them, but were hand scribbled paper containing the seals of the traders similar to rubber stamping on paper. 24) As metallic coins (money) continued to be used in different parts of the world in unorganized manner, interestingly similar to metallic and paper based money, leather based money also came to be used sometime before 9th century during the Han Dynasty, again in China. Specific pieces of specific types of leathers, assigned with certain value and imprinted with seals of Kingdom were used as money. This made one thing clear to the historians who studied the origin of money that whether it was use of high valued cowries for exchange, metallic coins, paper money or leather money, everything has originated only from China in Asiatic region. Why limit them, even paper which is the basic raw material meant for printing of Currencies and Bank Notes have originated only from China several centuries ago!

25) Prior to the use of paper for writing, thin material similar to Paper made of animal skins or other material to document the texts have been used in China during 9th century A.D and that led to the discovery of paper making technique. This thus strengthens the widely accepted theory that the paper money may have also surfaced first in China. 26) Thus money in the form of Coins, Paper and Leather were used independently in different provinces of China, in different periods of time and under different rulers during 9th and 10th centuries. 27) Between 9th and 10th century, even as coins were issued and used in different places including in certain provinces in China, some trading community in China resorted to the practice of issuing guarantee or assurance note in print form for trading purposes within their own territories. They were called Jiaozi notes and carried text message reading ‘the bill may be used instead of 77,000 wen of metal coinage’. Those notes were convertible into hard metal currency with any one of the traders who formed part of Jiaozi note user group. When the use of Jiaozi note gathered momentum, the note was circulated widely and was readily accepted amongst the traders. 28) When limited exercise of issuing paper money in the form of Jiaozi note gained momentum amongst the trading community, Song Dynasty in 10th century officially began printing and issuing the paper money very similar to Jiaozi notes and set up some agencies similar to banks for issue and exchange of those notes. However it was not made mandatory to use Jiaozi Paper Money for trading.

29) Numismatics is of the view that the Jiaozi note circulated in the 10th century was the stepping stone for the emergence of Bank Notes and Currencies. But during usage, one very confusing aspect found in those notes was multiple seals found stamped on the notes by the users. The value indicated on each of the assurance note continued to differ as the note kept on exchanged since the previous value was struck off and new value indicated by every next issuer of the assurance note. Thus the assurance note in the name of paper money kept on circulating amongst traders carrying different values till the life of the assurance note was lost in scribbling or stamping.

30) In this manner money on metal, leather and paper were put to use in several parts of the world in their own manner without assigning certain value for exchange and therefore they could not be used beyond the boundaries of the rulers or traders who issued or supported them. Of course in whatever format the money was issued, they were meant to be for used for trading only within their own territories. 31) During the year 1123 in one of the wars which led to the prolonged siege of city Tyre (in Lebanon), the Venetian captain Doge Domenigo Michieli exhausted his entire treasury chest and unable to pay wages for the huge army he took with him in the battle. Because of non payment of wages, soldiers resented and some even contemplated desertion from the army and therefore Doge issued to the troops specific sized cut pieces of leather as token money with his special seal impressed on them assuring that the value indicated in each of the leather pieces can be redeemed for full face value whenever they return back to Venice. This act had to be resorted to, as no form of regular money for use common to all, or exchange of money in alien land existed. The leather token issued by him thus came to be called military currency. 32) The concept of issuing money on leather continued till 13th century and even surfaced in the Yadava kingdom in Asia. The leather piece impressed with royal seal was considered money. The famous Mogul emperor Muhammad Bin Tughlaq too introduced leather currency in India on mass scale but it did not succeed. 33) When use of paper money concept caught the attention of Kublai Khan (also known as Genghis Khan), the most famous Mongol ruler of China who ruled in 13th Century, he introduced paper money and decreed that instead of Silver and Gold coins and bars, only the paper money issued by him be used by traders and to enforce it, he confiscated entire Gold and Silver in the country, even if it was brought in by foreign traders. Thus the use of paper money was seen widely prevalent in 13th century in China. 34) The chief officer deputed by Khan smeared the paper with vermilion powder, and impressed his seal with a semi wet seal bar, so that the seal remained imprinted upon paper in red colour. The excess powder was blown off. Only those with his seal were considered authentic for transacting as money. Anyone forging it would be punished with death. Kublai Khan made available vast quantity of this paper money which cost him nothing but equaled in amount all the treasure in the world. 35) However elsewhere in the world, the metallic coins too continued to be used simultaneously as money, but the most disturbing aspect noticed was non relating the value of paper money with that of the metal coins put in circulation. 36) Money coins issued in earlier era were not identical because the images were hand pressed from engraved stones or metals and therefore were not uniform. This caused each coin of the same value of the same territory differing in appearance. Also the metals being not machine cut the shape and sizes were also not uniform. 37) The money put to circulation in earlier era were non standard in size or in thickness or in weight or in appearance and caused confusion in identifying the coin which led to several working problems. This aspect was instrumental in standardizing the shape and size of the currencies and coins issued in the later era.

38) In later part of the millennium, in order to maintain uniformity in the money issued, die-struck coins impressed with some seal mark or image on one side or both sides came up. They were called ‘Punch mark’ coins.

39) When the western-Deccan and Central India were under the rule of Satavahanas, metal coins made of Copper and Lead have been issued. Some Silver coins have also been issued.

40) Since the metallic coins in use earlier were not of specific weight, neither their value nor the exchange rate against the paper money was made known. Therefore the coins issued were considered as representative money exchangeable for goods and other needs.

41) It is very interesting to note that the concept of paper money, first ever to surface in China got the attention of the Europeans through the travel reports of Marco polo, an Italian merchant traveler whose travels are recorded in a book that introduced Europeans to Central Asia and China. The concept of paper money was thus seeded by the Britishers in India only after 14th century. 42) In the meanwhile sometime in 15th or 16th Century, Sher Shah Suri, a Mogul King who reigned after King Humayun considered the practical difficulties of the non standard value of metal coins issued then and ensured in his regime that Silver Coins with specific grammage were only issued as money based on the standards of Britisher’s grains weight. This practice sailed through till 17th century under British India rule. According to the historians, the Indian currency i.e. rupee was brought into existence by Sher Shah Suri in the 16th century and it was evaluated as equal to 40 Copper coins per rupee. 43) Once the Britisher’s landed in India in 16th century under the guise of East India Company, they started minting and issuing metallic coins from mid 17th century. British settlers in western parts of India issued coins in Gold, Silver, Copper and Tin in the name of rupees, in addition to some kind of paper money. During the same period the princely states of pre-colonial India too issued their own coins, all of which resembled to that of the Silver Rupee.

44) As metal coins continued to be exchanged for trading in some parts of the world, in India British settlers in the Southern and Eastern provinces too like those settlers in the western part traded with some form of money and commenced issuance of coins in various metals in addition to the paper money for trading.

47) Initial coins issued in India carried the portrait of Mogul Emperors and Muslim Kings. When British gained control over the princely states, the supremacy of Mogul rulers ended resulting in the replacement of their Portraits on coins with that of Monarchs of Britain. Thus the dominance of Mughal over India started diminishing after Britishers arrived in the country, not only on the coins, but also on the paper money by replacing them with portraits of Monarchs of British emperors and Queen and which were widely introduced by the Britishers in the latter part of 17th and 18th century.

48) From plain Steel for minting money, bimetallic metals like Copper and Steel came to be used followed by Silver, Bronze and Gold. The metallic coins with some images impressed as seals were adopted across the world as money.

49) Almost all the Princely states within the then separate Indian States had put to use unique coins and paper money in different shapes, sizes, weights and denominations either on Paper, Gold, Silver, brass or other multi metals as money. 50) The circulation of non standard metal coins (in respect of weight, size, and shapes) belonging to several periods of rulers who issued them at their fancy without assigning specific value per coins caused several working problems. The metallic coins in the form of money of one area or territory could not be exchanged with the same valued coin or used outside their territory in which the rulers of the territories have issued coins for their own people.

51) The value attributed to each metallic money were originally not based on the value of the metal because they were only representative coins of territories in which they were issued. But over time when coins in metals such as Silver, Gold, Bronze and Copper were issued each of those metallic coins developed a value in their own right and differed substantially from the metal from which they were made and this subsequently came handy in valuating the metallic money in use. Just to understand the above logic see the example.

a) Ten coins of different metals, all weighing same were in use in different territories, if specific quantity of grain was received against one iron coin, twice the quantity of the same grain was given against Steel, three times against Copper, five times against Silver and ten times against Gold because while Iron was easily available, Gold was hard to get. This is simple example and not actual.

b) This is how the metals gained the denominational values of the metallic money in discreet manner and this reflected in the paper money issued initially reflecting variations in values of the paper money as evaluated by their sizes. For example paper money of one rupee note was very small, two rupees slightly bigger and ten thousand very big in size.

53) Slowly as the Coins continued to be used as money in several parts of the world in several formats, the concept and use of paper based money was not widely known or practiced in Asiatic region compared to metallic money till 17th century when Britishers were rulers even when some of the the private banks such as General Bank of India, Bank of Behar and Bank of Bengal commenced issuing some kind of paper money in the name of rupees in limited scale but in an organised manner. As pointed out earlier, even though in 14th century itself Europeans got the clue of some kind of paper money in use in China by the travel reports of Marco Polo, the concept was not put to practice in India immediately when Britishers landed in India.

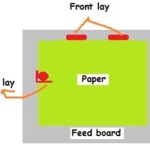

54) Prior to 1835, the East India Company (British Govt) issued coins through Bengal Presidency, Bombay Presidency and Madras Presidency, the three Banks established by the British East India Company (Banks of Bengal, Bombay and Madras). All the three Presidency banks issued their own coinages as one Gold mohur, two mohurs and in fractions of 1⁄16, 1⁄2, 1⁄3 and 1⁄4 rupee at various periods of time. Further those banks also issued money in the name of rupees and fractions thereof down to 1⁄8 and 1⁄16 rupee in metals such as Silver, some in Copper and some in Gold. Bank of Madras also issued two-rupee coins much later. 55) Those coins were circulated in local area for use in local trade. Thus the three Banks continued to issue both Metallic coins and Paper money till the Coinage act 1835 was enacted.

56) The Money issued prior to 1835 whether paper or metal, were called Sicca Rupees and those issued later were called simply Rupees. 57) Amongst the three banks, the Bank of Bengal originally known as Bank of Calcutta was already issuing limited quantity of paper money specifically for payment of revenues in certain circles even before it was officially sponsored by British rulers to issue the paper and metallic money as Presidency bank. 58) The Bank of Bengal with a capital of 50 laks Sicca Rupees equivalent to five million rupees issued Paper Money under the name Sicca Rupees.

a) ‘Unifaced’ Series which were one sided printed version and issued as one Gold Mohur.

b) The second was called ‘Commerce’ Series’ printed on both sides, carrying design elements.

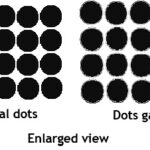

c) The third one was called ‘Britannia’ Series’ which had security features and motifs. 60) Against these developments when the Coinage Act 1835 was enacted the issue of coins came directly under the Govt and to standardise the coins. As per this act the weight of the rupee coin was standardized at 180 grains troy (one Tola) in which 165 grains should be pure Silver and remaining 15 grains would be alloy. Besides the weight, other aspects like multi composition of metals, their shape, overall size and design element on both sides were also standardized. The rupee coin bore the effigy of the British Emperor.

62) As both metallic coins and paper money were put to use, the messy situation of unorganized issue of Paper money led to temptations of abuse and disputes and led the Government to take over the issue of paper money as a sovereign prerogative when the threshold of the Banking industry begun and India were under the rule of Britishers. 63) It is also note worthy that in those period of time, the paper money was limited to only privileged set of users and was not transacted on mass scale. 64) Why were the metallic as well as paper money called rupees? Rupee probably is a word derived from Sanskrit. ‘Rupiah’ means ‘stamped or image impressed metal coin’. Therefore the word Rupee could have possibly emerged from this word Rupiah. Earlier the rupee coins were made up of Silver and therefore Silver coins were called ‘rupyakam’. In Sanskrit language rupyakam means Silver coin. May be rupee is singular and rupees plural thus rupees meant several coins. Probably that could also be the reason why when lowest valued note was referred to as one rupee and more than one rupee valued notes were called as two rupees, five rupees, ten rupees and so on. 65) The status of Paper Money gained momentum and respect in the 18th century only after Bank of Bombay, Bank of Bengal and Bank of Madras were established by the East India Company in the name of Presidency banks for the task of issuing and circulating the new Paper Money in addition to the issuance of the metallic coins which was already going on. However those banks were not Governmental banks but were only supported by the Govt for the task of issuance of the paper money. 66) Along with the three presidency Banks, private banks such as Commercial Bank, Union Bank, Bank of Western India and Asiatic Bank too issued Currencies in tandem with the Presidency banks. 67) Further the Paper currency act enacted in the year 1861 conferred upon the British Govt ruling India then, that the monopoly of issuance of Paper Money and the Presidency banks naturally became agents of secretary of states for the issuance of paper money as they were already experienced in this respect. Once act enacted, eventually the management of paper currency was entrusted to the Mint masters, the Accountant Generals and the Controller of Currency.

68) The Currencies issued initially did not resemble to that of modern era printed currencies which has many overt and covert features, but were more of a simple form of bill or coupon portraying the value of those notes in multi lingual words, name of the bank and the signature of the person who issued it. No design elements were added, no security features found, and no special paper like Watermark paper were also used.

a) For example when the weight of a Silver coin issued was 20 gms and valued as one rupee, it became obligatory to issue one Silver coin weighing 20 gms against one rupee note whenever produced in the bank. When the value of the Silver went up and equaled to 1½ rupee, still one coin of Silver weighing 20 gms had to be issued against one rupee note produced resulting in a loss of ½ rupee per every one coin exchanged against one rupee paper money. This resulted in huge loss to the banks as they had transacted with huge quantity of coins everyday.

b) Since the Banks were obliged to issue equivalent quantity of metallic coins in lieu of the value of the Paper Money that guaranteed the payment, it caused economic crisis in the Banks on account of declining profits. Those issues were not anticipated in advance. This resulted in the closure of some of the banks and to subsequently amalgamate with their parent firm Alexandria & company.

71) All such aspects and anomalies were studied and well taken care of to prevent incurring loss in banking operations while issuing the metallic money after enacting the coinage act. Some of the measures taken to prevent losses were by readjusting the weight of metallic coins to match the value of the paper money for the same value of coins issued. For example, on the issue of Silver coins, whenever the price of Silver went up, it reflected on the cost per coin, and therefore either the weight of the pure Silver coins were reduced in size or in their thickness, or pure Silver content in the coins altered by issuing bi metallic coin with only certain percentage of Silver content, rest being other metal so that the face value of the metals did not exceed face value of the paper money against which it was exchanged. Thus the value of the metallic coins and paper money issued were determined and necessary modifications done. All such factors hastened the thinking to issue more paper money instead of issuance of metallic coins. 72) Initially the Paper Money issued had carried only three languages like Urdu, Bengali and Devanagari (Hindi)besides English because all the activities for the issuance of the Paper Money began from the northern parts of Asia where many areas were under Muslim rulers and whose population spoke the language Urdu. 73) Since first of the Bank established was in Bengal whose people spoke mainly Bengali and rest were Hindi or Sanskrit speaking people, Bengali and Devanagari (Hindi) languages besides English were given more prominence on the language panels of the notes issued. 74) The notes issued prior to the takeover by Reserve Bank of India from the year 1950 were issued by the Govt as official Currency notes and the printed promissory clause carried the signature of Commissioner for Government of India. The currencies were then issued from the banks in Allahabad, Calcutta, Bombay, Karachi and Rangoon (presently Myanmar also known as Burma). 75) The currencies showed the issue Office by an alphabet printed glaringly. For example alphabets like ‘R’ for Rangoon, ‘B’ for Bombay, ‘K’ for Kolkata etc. The value of the paper money were in numerals like Rs 10, Rs 20, Rs 100 and so on, followed by words say ten rupees, twenty rupees, hundred rupees etc along with some design elements printed in one or two colours. 76) Initially Paper Money called Currencies were issued in denominations of Rs.10, Rs.15, Rs.20, Rs.25, Rs.50, Rs.100, Rs.250, Rs.500, Rs.1000, and Rs.10,000.

a) Indian Currencies imprinted with text like ‘For use in Pakistan’ have been issued.

b) When Burma was separated from India in the year 1938, the Reserve Bank of India took the responsibility of issuing the Currencies. For many years the Indian Currencies overprinted with ‘Burma Currency Board / Legal Tender in Burma only’ were in use in Burma.

c) During Britishers rule, Indian Currencies were in circulation in the Gulf countries as External rupees, printed entirely in different colour compared to the one issued in India with special Alphabet Z appearing in number panel to indicate that it was external note of India meant for use only in Gulf countries.

d) In addition to Gulf Currencies, the Government of India also arranged for the special issue and distribution of the Currencies to ease the problem of Haj Pilgrims visiting Saudi Arabia beginning from the year 1959. The Haj Currencies were issued to pilgrims proceeding on Haj Pilgrimage to Saudi Arabia and they were valid exchangeable Currencies against local Currencies. The Indian Currencies with ‘Haj’ imprint on them carried by the Pilgrims could be exchanged on par with local Currencies anywhere in Saudi Arabia which in turn were collected by the Banks and sent back to India for conversion into foreign exchange. This arrangement was however subsequently withdrawn after few years of experimentation.

e) Rs 1000 and 10,000 notes were first printed in the year 1938.

f) After incorporating several Security features which were not easily counterfeitable, the “Mahatma Gandhi Series” was introduced in 1996.

g) In the year 1946, two Ordinances were issued, demonetizing notes of the denominational value of Rs.500 and above.

h) The currency sign of Rupee Symbol was adopted by the Government of India in 2010 as a symbol for Indian Rupee on par with the European pattern where they have their own symbol for the Currencies. The rest is history. 88) The total value of bank notes in circulation at the end of March 2015 was 14289** billion rupees (Rs 14289000000000/-) equivalent to 83,579 million pieces of notes in various denominations. It was 8044.45 million pieces of notes during 1970-71. While the volume of currencies issued is around 11% increase compared to the previous year, the value of the same worked out to only around 8% which indicates that the circulation of notes have not gone up very high and remains controlled considering the all round price level rise in economy. 89) Similarly the total value of metallic coins in circulation at the end of March 2015 was 98,964 pieces of all denominations equivalent to 194** billion rupees (Rs 194000000000/-). (**Figures based on Annual report of RBI)

1) Initially when the paper currency which had no physical value, began to be issued, it was released with a solemn promise that the holder of the note would be given equivalent value in Silver or Gold coins as and when the paper currency is exchanged. That means paper currencies are freely convertible into specific quantities of Gold or silver. Thus the value of each of the paper money issued was based on precious yellow or white metal.

2) Therefore each piece of paper money was accounted and could not be released just like coupons as each one of them needed to be guaranteed by precious metals such as Gold or Silver.

3) In order to stand guarantee for the value of the paper money issued by the countries, the practice such as Silver or Gold Standard became the norm.

4) A Gold or Silver standard or Gold or Siver reserve is the quantum of such metal held by a national central bank, intended as a store of value and guarantee to pay depositors, paper money holders, or trading peers, to secure a currency. The countries which had adapted Gold or Silver standard agreed to convert paper money into a fixed quantity of Gold or Silver.

5) The Gold or Silver reserve policy was primarily meant to maintain trust in the money such that we can pay strangers of any country, money bond redeemable from the issuers country in settlement of obligations without having to worry whether such strangers will decline the money bond in internationally accepted format exchangeable in any part of the world.

6) Between 17th till the first quarter of 19th century the currency systems of the world were based upon Silver i.e. Silver coins issued in particular weight to equivalent value of paper money.

7) However since the Silver crisis emerged in the year 1873, number of nations adopted Gold standard but India continued to remain on the Silver standard.

8) During the period from 1919 to 1925,

worldwide successful effort was made to replace the monetary system from Silver standard to the Gold Standard system. It did not succeed.9) Why was Gold standard insisted and other metals not preferred? The reason was that the metal was precious, nature born and cannot be artificially made with combination of metals. Thus Gold is not made but found as ore in rocks and it occurs naturally in an elemental form.

11) Most nations abandoned the Gold standard as the basis of their monetary systems at some point in the 20th century, although some of the countries still hold substantial Gold reserves.

12) Thereafter money in India are no longer backed only by Gold or Silver but also partially backed by internationally accepted other norms and instruments such as reserve foreign exchange, internationally acceptable security bonds etc.

13) Several other factors too contributed to the cause of abolishing Gold standard, one of which is space constraint to hold the ever increasing quantities of Gold or Silver against the Paper currencies issued.

14) It has been estimated that the entire Gold mined in the world by the end of 2011 totaled to 171,300 tonnes and India has little over 550 Metric tons as of 2012.

Reserve Currency

1) A reserve currency or reserve money is foreign currency held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe haven currency.

2) In the recent past it has been internationally accepted that it is not necessary that Gold reserve alone be kept against the value of Currencies as there are internationally accepted other norms and instruments as mentioned in pre paras were available.

3) Since only few nations had their own resources for generating Gold, the fluctuation of the metal put strain on the value of other currencies of other nations. Therefore foreign exchange reserves, security deposits in foreign banks, and Forex came to be adapted.

4) Foreign-exchange reserves (also called forex reserves or FX reserves) are assets held by a central bank usually in various reserve currencies, mostly the United States dollar, and to a lesser extent the Euro, the Pound Sterling, and the Japanese Yen, and used to back its liabilities e.g., the local currency issued, and the various bank reserves deposited with the central bank by the government or by financial institutions.

5) Holding the currencies of other countries as assets or deposits allow governments to keep their currencies stable and reduce the effect of economic shocks. The use of foreign exchange reserves became popular after the decline of the Gold standard.

6) The development of the modern concept of a reserve currency took place in the mid nineteenth century. Why reserve currency is important because they are internationally accepted assets like Gold and Silver standards. Therefore the countries simply stockpile reserve currencies such as the USD or Euro in order to avoid the additional costs incurred by way of paying more money while in exchange whenever the foreign currencies value rose higher.

7) In short it is suffice if we understand that all such measures are meant for the purpose of safeguarding or honoring the promised value of the issued Paper money against bankruptcy.

What is Fiat Money?

1) Fiat money is guaranteed paper or coin money of the Govt that assured value indicated in them by itself without linking them to Gold or Silver and therefore the banks are not obliged to replace the money with either Gold or Silver. However since it is guaranteed money they are obliged to give small changes of coins or paper money in equivalent value against the same and cannot be refused to be accepted against any payment.

2) In short, the Fiat money is money declared by a government to be legal tender or a state issued money with certain face value attached to them by Govt decree and freely exchangeable for any commodity unlike representative money which is backed by Gold or Silver with the legal requirement that the bank of issue of the representative money redeem it in fixed weights of Gold or Silver only.

3) The paper money issued in 11th century in China under Yuan and Sang dynasty is believed to be the first ever Fiat money issued in the world.

4) Indian currency is Fiat money as it is pegged to the US dollar and not to Gold or Silver.

Who issues Coins and Currencies in India.

1) Though the Govt of India is sole authority to issue of Coins and Currencies, the issue has been divided between the Govt and RBI by certain acts. While the issue of Coin rests with the Govt of India, the Reserve Bank of India has been assigned the task of issuing the Currencies in the name of Bank Notes. Thus the authorities to issue Coins and Currencies are held by two agencies.

2) One may wonder why the Govt has not entirely kept the issue of both metallic and paper money and entrusted a part of it to RBI. Also why one rupee paper money is issued by the Govt, while the rest of the paper money i.e bank notes commencing from two rupees notes and onwards are issued by RBI?

3) During Britisher’s rule coinage act was enacted in the year 1835 placing the prerogative of issuing and standardizing the coins with the Govt. However after India attained Independence, the coinage act 1835 was amended as ‘Coinage act 1906’ which not only conferred upon the Govt the monopoly of issuing metallic coins but also bringing the entire mints under its authority and control. Even after the formation of RBI this act has not been amended to transfer the authority of issuing the Coins to RBI. Hence the Govt of India is directly minting the coins in the mints under their control however in consultation with RBI, who places annual indent for the supply of coins and the Govt draws up the production plan to supply Coins to RBI.

4) Similarly the Paper currency act 1861 enacted by the British Govt was superseded by another act in the year 1934 to establish Reserve Bank of India on the basis of the report of the Royal Commission on Indian Currency and Finance. The commission was also known as Hiltan-Young commission. From the year 1861 to 1934 Govt of India under British rule managed the issue of paper currency under the paper currency act 1861 and in deference to the Reserve Bank of India Act 1934, the issue of paper currency was entrusted to RBI and w.e.f 1950 the Indian currency notes are printed and issued exclusively by RBI on behalf of Govt of India.

5) During world war the Govt unable to meet the requirement of coins in one rupee denomination due to scarcity of metal, resorted to the issue of one rupee paper money in place of metallic coin as temporary measure. Since the prerogative of minting of coins was held by the Govt, the one rupee note, replacement to one rupee coin was held by the Govt and the promissory clause is signed by the Secretary of Finance instead of the RBI Governor.

6) This is how two different agencies are controlling the issue of Coins and Paper currencies in India.

Who decides the quantum of money issued and what is the basis?

1) The Govt in consultation with RBI decides the quantum of bank notes to be printed annually based on the income and expenditure and the revenue linked to the economics of the Country. The most important factors taken into consideration for the printing and circulation of currencies are GDP & GNP growth, inflation, replacement of soiled and spoiled notes etc.

2) GDP is Gross Domestic Product which is derived by measuring entire income of the products and services rendered within the country after deducting the expenditure involved in them. Similarly the GNP is Gross National Income which is derived by measuring entire income coming from external sources i.e beyond the country after deducting the amount given back for the services rendered by the foreigners.

7) Let us understand the logic of how the currency in demand for each year is worked out with a very simple example as shown below which is only to understand the logic by a simple narration. The example is meant to only show the logic and not accurate work out.

a) Assume in a nation with Rs 1300 crore quantum of currencies issued by the Govt, a group of manufacturers produce certain quantity of goods and services, valued to a total of Rs 1000 crore within a particular year.

b) During the particular year the goods and services thus produced above are consumed by the public to the extent of Rs 1000 crore available with them out of Rs 1300 crore money in circulation.

c) Thus the public money valued at Rs 1000 crore goes to the manufacturer or producer of the goods and services. Thus the manufacturer or producer who is also one amongst Rs 1300 crore money in circulation gets additional Rs 1000 crore for the said year for the goods and services produced by them. The manufacturer thus with the extra money (Rs 1000 crore) received from public produce more and more goods say goods and services worth Rs 2000 crore (Instead of 1000 crore produced in the previous year) with the extra money received.

d) In above scenario the money with public goes down and they do not have currencies to to purchase the extra goods worth Rs 2000 crore since the total volume of currencies in circulation was only Rs 1300 crore. Therefore Govt releases further currencies to level the value of 2000 Crore rupees.

f) This is how the Govt of a nation takes into account the Growth of Domestic Product and goods with their value and decides the quantum of currencies required to meet both ends. Thus the nation initially worth Rs 1300 crores will plan to circulate not less than Rs 2000 crores money taking into consideration the previous years scenario so that the money will circulate amongst public and manufacturers indirectly raising the value of GDP too to Rs 2000 crore for the nation in the ensuing year.

g) Similarly the same principle is applied in the case of working out the Gross National Product in which the total value of income earned from other nations after deducting the expenditures involved in it is worked out to arrive at the total currency in demand.

h) On their part RBI while advising the Govt on the circulation of the currencies takes into consideration the growth rate in economy, increase in money supply needed for growth in economy, increase in demand for money supply, replacement for spoiled and soiled notes, reserve requirement, PFCE i.e private final consumption expenditure, seasonal fluctuation etc. Though RBI has the power to print the currency, still the Govt has the final say on majority of RBI actions including various denominations to be printed, design elements and security features etc.

How is the value of the currency determined?

1) A country that used the Gold or Silver standard set a fixed price for the Gold or Silver and brought and sold them at the announced rate and thus the said rate determine the exchange value of the currencies of that Country. This is one of the important factor that determines the exchange value of a nation’s currencies with currencies of other nations.

What will happen if more notes are printed and circulated?

Who monitors the situation of the circulation of currencies?

Are there any international restriction?

1) The Reserve Bank decides upon the volume and value of bank notes to be printed. Based on the demand requirement as worked out by RBI with statistics and several methodologies, they indicate the volume and value of banknotes to be printed each year to the Government of India which approves the final requirement in mutual consultation with RBI. The quantum of banknotes to be printed annually depends broadly on the demand for banknotes by public, GDP growth, replacement of soiled banknotes etc.

2) Let’s understand it with the following example.

a) Supposing the nation has 1000 crore rupee asset (national income by several activities) and it is divided amongst 1000 people in the nation. Now instead of giving 1000 crore in cash you give each of them a coupon which can be used for needs. This means the 1000 crore is divided for 1000 family members and each get one coupon valued to 1 crore to enjoy.

b) Sometime later the population goes up to 2000 people. There is no increase in asset, and then what will be the status of each coupon?

(i) The coupons cannot be cut into half and issued. The Govt will have to therefore print additional 1000 coupons to give each a coupon. Since there is no increase in the assets (national growth by activities) the value of each coupon will be reduce to 50% i.e each member will have only 0.5 crore to enjoy.

(ii) However to retain the value of the coupons as one crore per coupon issued to 2000 people, the Govt will have to increase the national asset.

(iii) Supposing the value of asset increases to 2000 crores, but the population has remained static as only 1000 people, the Govt will not issue more coupons to pay each member a coupon , but the value of the coupon will go up as 2 crore per coupon.

3) Therefore simply printing more currencies for circulation without increasing the national asset by way of growth in activities will only decrease the value of the currency, increase inflation and ultimately bring down the exchange value of the currencies against the foreign currencies.

4) Every nation can circulate currencies only to the extent of reserves kept in all spheres and in all formats. Supposing the nation has reserve to back up only 1000 rupees it can circulate notes including the metallic coins only to the extent of 1000 rupees. It can be any no of currencies or coins consisting of several denominations or simple two denominations, it does not matter. However the total value of such notes shall not exceed 1000 rupees or less. In such a status let us assume that in the exchange rate of rupees is say 50 rupees per dollar or Euro.

5) Now the nation has circulated 1100 rupees worth of currencies against reserve back up of 1000 rupees. What will happen to the exchange rate of rupees per dollar or Euro? The exchange rate will become 55 rupees (1100÷1000 x 50 = 55 ) per dollar or Euro . That means the rupee value has decreased in international market.

a) When the value of rupee has goes down, for every international trade or dealings you may have to pay more money in every international transaction. If the trend continues, the nation will face fall in economic growth and receptivity of currency in International area in trading. The support from the International monetary fund or World Bank will be affected ultimately ruining the economy. Therefore a nation cannot afford to print more currencies beyond their reserve back up.

6) The International Monetary Fund (IMF) consisting of several nations keep an eye on the issues of money in circulation and a nation’s economy by special surveillance group and takes appropriate action to warn the member nations exceeding the limits of money put to circulation imbalance to their assets and growth. Since the IMF in tandem with World Bank function as credit institution and lend short term and long term loans to overcome financial crunches appropriately to the growth activities of the member nations and they are considered to be the watch dogs on the economy of the nations.

7) The International Monetary Fund (IMF) is an international organization headquartered in Washington, DC, consisting of 188 countries working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

Recent Comments