An analysis on Printing and circulation of Paper Money -4

-Analysis-

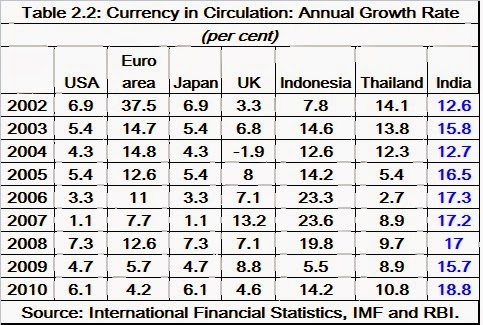

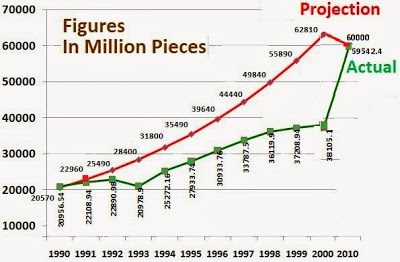

The ever fast growing volume of Currency posed serious problems to Reserve bank of India, not only in production and putting them into circulation with a well organized mechanism, but also in salvaging the Soiled notes into usable and unusable category, all of which came back to the banks for re circulation or to destroyed as unserviceable notes without reaching the hands of public again. Ever since the RBI was established, Bank Notes in circulation which was in the range of 100** million pieces in the year 1935 rose to over 18500** million pieces of Bank notes in the year 1975 (** Ref : Chapter-1/ Introduction /Para 1.3 / Report of the Committee on Currency Management). There is a slight variation in the figure brought by the Expert Committee and the RBI Database statistics which show the issued/ circulated Bank Notes as 18288.7^^ million pieces (^^Ref:- Database on Indian Economy/ RBI Data Warehouse: Table 159 : Notes and Coins Issued). However the difference being minor, this variation is ignored and RBI Database figure taken as authentic for later calculations.

Finding infrastructural facilities including the staff position remaining disproportionate to process the ever increasing supply and demand for Bank Notes, the RBI in deference to the wishes of the then Governor of RBI who desired that a high power Committee be constituted to go into the entire gamut of issues in the area of Currency Management, constituted a Committee in December, 1988 under the Chairmanship of Shri P.R. Nayak, Deputy Governor to study all aspects and recommend in respect of Currency Management. In over nine sittings spread over few months, the Committee studied various aspects of the Issue and Circulation of Bank Notes and Coins and gave a report in the year 1989. Some of the observations in the report are interesting to read. See below for details:

Quote:

Para 2.1 :- ”The increase in the value of currency notes since 1970 and the growth of volume are illustrated in Fig…..(projection of bank notes shown below) . A sharp break in the rates of growth is observed from 1975. In the decade of the 1980’s, the value has grown by about 90% every five years and the volume, by more than 50%, indicating that the higher denomination notes were growing faster than the others”.

Para 2.2:- ”The very high rate of growth in currency requirement and the consequent stepping up of the production of fresh notes, though short of the needs, has increased the volume of notes passing through the Issue Offices to the currency chests. It has also led to a rising flood of notes offered for withdrawal from circulation, as being unfit for further use. Fig..(projection of bank notes shown below) shows a total average traffic of over 12,800 million pieces during the three years 1986-1989”.

Unquote-

While giving Projection on the requirement of Bank Notes, the Expert Committee has taken into account year wise requirement of Re 1/-, Rs 2/- and Rs 5/- separately and projected the requirement. However in respect of Rs 10/-, Rs 20/-, Rs 50/-, Rs 100/- denominations they have shown only consolidated requirement clubbing all denominations beginning from Rs 10 to Rs 100/- without giving separate breakup. The reason is not known. The Committee has also not projected any requirement of Rs 500/- or that of Rs 1000/- denominations. The Committee opined that by 2010 the Bank Note circulation could go up to 94,000 million pieces, and in case some denominational notes are coinised in the intervening period, then the requirement of Bank Notes would come down to 60,000 million pieces in 2010.

Quote :-

Para 6.2 : Note circulation of about 94,000 million pieces is entirely possible in the year 2010. If the Rs 10 denomination is coinised, in the meantime, as is likely, the circulation could be curbed and contained at 60,000 million notes. The quality of notes in circulation will not be allowed to deteriorate from the standard set in the nineties. Under these circumstances, note circulation will need the infusion of 30,000 million fresh notes in the year 2010 and will also require the withdrawal of 24,000 million pieces. In short, all the parameters of note circulation assumed for the year 2000 will be slightly more than doubled in the year 2010.

(Ref: Page 52 of ‘Report of the Committee on Currency Management‘)

Based on certain statistical data, the Reserve Bank decides upon the Volume and Value of Bank Notes to be printed annually. The quantum of Bank Notes that needs to be printed annually depends broadly on the annual increase in Bank Note required for circulation, replacement of Soiled notes and Reserve requirements. The demand for Paper Money or Coinage increases or decreases on account of several factors such as growth in industrial production, high growth or slump in exports and imports, employment generation through many projects, salaries and wages paid in liquid cash, several other industrial transactions, to some extent inflation and cost of living index, extent of transactions by cards, ATMs requiring more cash for dispensation etc, etc . All these factors form part of RBI’s plan of action while working out the annual Currency requirements. Therefore one should not hastily conclude that the Paper Money in circulation is maintained at the same level from the day the issuance of Paper money commenced.

Recent Comments