Origin and growth of Bank Notes and Currencies – 5

Origin and growth of

Bank Notes and Currencies – 5

(Written by N.R. Jayaraman)

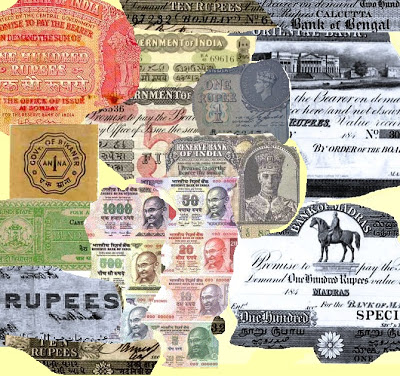

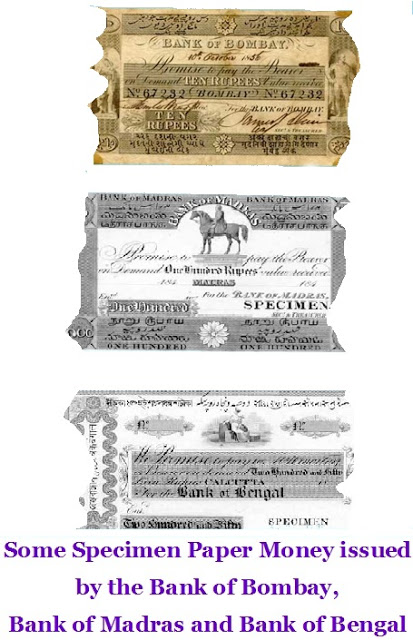

As I mentioned earlier the unorganized issue of Paper Money against the Metallic Coins paved way for temptations for abuse were great and the disputes and problems arising out of those instruments led the Government to take over the issue of paper money as a sovereign prerogative when the threshold of the Banking industry begun when India came under the rule of Britishers. The status of the Paper Money gained momentum and respect sometime in the 19th century when the partially Govt controlled banks started issuing Currencies. Three major Banks were initially established by the East India Company who were the rulers of India then and allowed the banks to function independently. Called Presidency banks, the established banks were in the name of Bank of Bengal (1809), Bank of Bombay (1840) and Bank of Madras in the year 1843.

The task of issuance and circulation of the new Paper Money was conferred on the presidency banks and the Government assured that the Govt would open up treasuries to places where the banks would open branches which will expand the use of Paper Money in place of Coins.

Except the Bank of Bengal which had a branch in Mirzapore none other Banks had branches at that period. In order to spread Banking through which the traders can use more of Paper Money, Govt gave an solemn assurance to the Presidency Banks that the Govt would support the Banks by opening more treasuries if the Banks opened up new branches all over. In light of such an assurance the three Banks opened up several branches.

Wide use of Paper Money issued by the Banks, however, came with the Paper Money issues of the semi-government Banks i.e the Presidency Banks, notably the Bank of Bengal which was originally known as the Bank of Calcutta founded mainly to fund General Wellesley’s wars against Tipu Sultan and the Marathas. Actually it was renamed as Bank of Bengal in the year 1809. Again in 1862, the Bank of Bengal amalgamated Dacca Bank (est. 1846). These banks established by Government had an intimate relationship with the Government. The charter granted to these banks accorded them the privilege of issuing Paper Money for circulation within specific circles only.

The Bank of Bengal with a capital of 50 lakhs Sicca Rupees equivalent to five million rupees issued Paper Money under the name Sicca Rupees. Paper Money issued by the Bank of Bengal can broadly be categorized into three series namely :

‘Unifaced’ Series which were of one sided printed version and issued as one Gold Mohur. They were in denominations like 100/-, 250/- and 500/-.

The second called ‘Commerce’ Series’ was printed Paper Money on both sides, carrying some design elements including that of Portraits of British rulers. The issue Banker’s name was printed on the back side indicating the value (deno) in three languages like Urdu, Bengali and Devanagari(Hindi).

The third one was called ‘Britannia’ Series’ which incorporated more security features and motifs.

The Coinage act of 1835 was in force then and therefore the Paper Money issued prior to 1835 were called Sicca Rupees. Once the Coinage Act came into being the Paper Money issued carried the name of the Company as issuer and the amount in word Rupees instead as Sicca Rupees. Paper Money called Currencies were issued in denominations of Rs.10, Rs.15, Rs.20, Rs.25, Rs.50, Rs.100, Rs.250, Rs.500, Rs.1000, and Rs.10,000. The design elements were simple and the Paper Money had three languages – Urdu, Bengali and Devanagari – inscribed in them.

Prior to the establishment of the said three Banks private banks in the name of Commercial Bank, Union Bank, Bank of Western India and Asiatic Bank were also operating. The three Govt established banks issued Currencies in tantam with private banks. This is how the earlier format of Currencies introduced by the private banks snowballed into establishment of State functioning Currency issue offices and treasuries some time in 1860 for the issue of Currencies and Bank Paper Money through well organized structure.

When the second Presidency Bank was established in 1840 in Bombay the design elements in the Paper Money included the statues of the then known leading personalities like Mountstaurt Elphinstone, John Malcom etc.

The third in the series of Banks established was the Bank of Madras in the year 1843 on the same model of Bank of Bengal and Bank of Bombay.

The Bank of Madras had the smallest issue of bank Paper Money, which were not accepted by the Government for revenue purposes. The Paper Money of the Bank of Madras bore the vignette of Sir Thomas Munroe, Governor of Madras (1817-1827). Initially, the Presidency Banks were appointed as agents to promote the circulation of these Paper Money in view of their existing infrastructure. The Bank of Calcutta, and the two other Presidency banks, namely, the Bank of Bombay and the Bank of Madras were amalgamated and the reorganized banking entity was named the Imperial Bank of India in the year 1921.

The Paper money act came at a much later stage that legalized the issuance of Paper Currency.

Recent Comments