All about Stamp Papers

All about Stamp Papers

(Written by : N.R. Jayaraman)

It is unclear who invented the concept of Stamp Papers but it is widely accepted that the origin is from Netherlands introduced in the 16th century. Three decades later the concept of Stamp Papers came to be extensively used in France. Further three decades later the concept spread to Great Britain, United States of America, India and other countries.

When we read the history on Stamp paper, it is seen that in Europe it was first introduced by the British Govt in the name of Stamp Act in the year 1765 to get revenue by way of direct tax to meet the expenses of British troops stationed in the colonies controlled by them during the Seven Years’ War (1756-63). It required the colonists (countries occupied by British forces) to pay tax by pasting authorized stamp on all sorts of printed material to show that the tax had been paid. The Govt imposed taxes through the use of embossed revenue stamps, also known as impressed duty stamps and the embossed revenue stamp could be impressed upon ordinary paper. But due to stiff opposition especially from American colonies, it was withdrawn, but later years the concept of using Stamp Paper came to be accepted by many countries in different other form, one amongst them being the use of Revenue stamps for some transactions while keeping the use of Stamp Papers for rest of the transactions.

There is often a confusion on the use of Stamp Paper and Revenue Stamp both of which are meant for collecting taxes or generating revenues to the states (Govt). Certain transactions such as buying, selling or leasing or renting of properties, power of attorney, business agreements which has a financial aspect on them need legal authentication because even after signed by the concerned parties involved in such agreements, if one of the parties withdrew from the agreements which are written on ordinary paper they will have no legal sanctity. Those documents will only be valid when they are laid on a specific valued Stamp Paper. Thus the sale of the papers called Stamped Paper generated revenue for the government and acted as a kind of transaction tax. Stamped document is thus considered much more authenticable and reliable rather than an unstamped document especially for use in any litigation since only Stamp documents stand scrutiny in the judicial courts. The importance of Stamp Paper can be thus understood. Paying stamp duty is an essential part of almost any transaction you do in a country where the law endorsed it by enacting appropriate law in the name of Stamp Act.

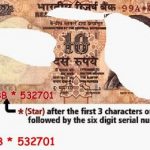

While the importance of the Stamp Paper is as stated as above, the Revenue stamp has a different status. Unless a Revenue Stamp is affixed on the receipts as an acknowledgement for the money transaction carried out in any of the transactions like money lending, agreements or contracts in respect of moveable and immovable properties or even performances of services, it stands to lose legal sanctity. Revenue stamps have also been produced and used as tax or duty or fiscal stamps in relation to the tax of many different products. For example products such as Match boxes, Cigarettes or even liquor bottles carried tax stamps affixed on them. Thus Stamp Paper and Revenue stamps both form parts of the same coin.First let us understand what a Stamp Paper is. The Stamp Papers are nothing but blank special paper printed with the images of a Revenue Stamp and the appearance of the printed image is almost similar to currency notes. Stamp paper is a Govt stamped document sold in both sizes of foolscap or A4 size and used in many countries for generating revenues in the form of stamp duties since other forms of taxes are difficult to collect. In recent years the E stamping slowly replaces the use of stamp paper in view of the forgeries and counterfeiting noticed.

Every Stamp Paper carries a monetary value, but neither is it a negotiable instrument nor it can be exchanged like currency notes. These papers are used for endorsing authenticity to official agreements and documents. Almost all documents carrying legal implications such as Wills, Several types of agreements between parties, Buying and Selling of properties, Business or Contract agreements in projects or firms, many kinds of financial deals, Power of Attorney, Affidavits of varied nature, Articles of Association, Memorandum of Association, Indemnity Bond, Declarations of many sorts, Mortgage, Gift Deed, Will etc. are to be executed on Stamp Papers to make them legally valid and enforceable. While the term agreements between two parties is a very wide term which may restrict to two parties such as transfer of properties to transfer of rights etc, in the case of business contracts between parties done under Indian Contract Acts,1872 , the agreement and signing of the contracts on Stamp Paper is not mandatory.

However certain agreements which can be used as admissible evidences in a court of law has to be done only on judicial Stamped Paper as per Section 35, defined under Indian Stamp Act, 1899. Section 35 under stamp act says:

Quote:

“Instruments not duly stamped inadmissible in evidence, etc.—No instrument chargeable with duty shall be admitted in evidence for any purpose by any person having by law or consent of parties authority to receive evidence, or shall be acted upon, registered or authenticated by any such person or by any public officer, unless such instrument is duly stamped”

– Unquote

In India the values of stamp duty required for each of the transactions are fixed by the State government for each set of transaction and the values vary from state to state. 14 different varieties of Stamp Papers available in ten denominations are to be accordingly purchased.

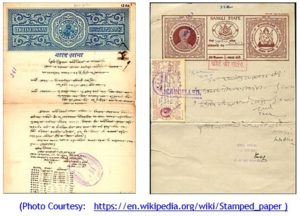

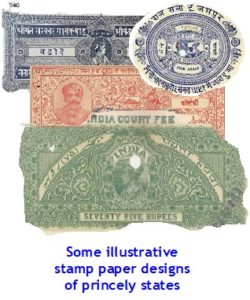

Initially the Stamp papers were printed by Offset or Letterpress process of printing and slowly intricate Intaglio printed designs came to replace some of them. The Stamp papers are incorporated with a printed design on one side of the paper showing the state emblem, the value etc occupying a third or fourth of the paper, many times occupying the entire width of the top part of the paper, rest left blank for incorporating the contents of the deeds or transactions or agreements. The paper has embedded water mark too. Early examples of Stamped Paper from British India and the Princely States were simpler and often colorless, much like a notary’s seal. Later, they were replaced by typeset or engraved stamps. Subsequently, colour was added, and printed Stamp Papers for many of the Princely states were even imported from Europe for some time.

The Stamp papers are sold by certain Banks, and Authorized or Licensed vendors of the Govt. Prior to licensing the vendors, the Stamp Papers were sold only in Post Offices and in Banks. However electronic versions were developed in the last few decades in order to reduce the risk of fraud after the Telgi scam surfaced. Telgi counterfeited Stamp Papers and sold them with a network of 300 plus agents spread across to the banks, stock brokerage firms, corporate houses and insurance companies defrauding the nation of its revenue. Therefore several steps such as E stamping and franking the stamped document have been taken besides change in the designs of the Stamp Paper.

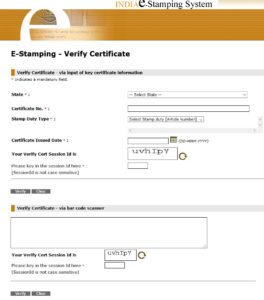

It is learnt that new Stamp Papers are being printed on specific paper with intricate security features in addition to the use of special security inks and special techniques. The new Stamp Paper will be state specific as the names of the states will also be printed on the Stamped area. They will also bear a serial number so that it can be easily tracked. According to a finance ministry release, the stamps are serially numbered, so as to make the task of tracking very easy. Complexities in the security features are commensurate with the face value of the stamps. High value stamps are printed on special paper with intricate security features for easy identification. The genuineness of a Stamp Paper can be prima facie seen through distinctive features such as Water mark, Ashoka Pillar, Four-headed lion emblem and Security code parallel to the stamp paper. However to find out the Authenticity of the e-Stamp Paper one can visit the website shcilestamp.com and get the verification done following few steps given below since Stock Holding Corporation of India Limited has been authorized by the Govt for E stamping applications.

Stamp papers have been widely used around the world to collect taxes on various documents. The papers are always bought blank and contents entered either by typing or writing. One has to be careful while typing or inserting the contents. Typing or entering the contents has to start only from below the stamped image, lest the Stamped Paper will not be registered. The second important point is that the back side of the Stamp Paper cannot be used to continue the second page contents. One will have to purchase another Stamp Paper and continue incorporating the contents of the instrument being registered. As the revenue from stamp duty is assigned to the State in which they are collected, each State Government has prescribed by rule that stamps purchased in the particular State alone should be used for instruments executed in it. The provisions regarding levying, collection and payment of stamp duty are contained in the Indian Stamp Act 1899.

They are of two types of Stamp Papers are available used for registration of several varieties of documents. The two types of Stamp Papers are:

(a) Judicial Stamp Paper and (b) Non Judicial Stamp Paper.

Stamp Duty paid in respect of Non-Judicial stamp paper is paid under The Indian Stamp Act, 1899 and Stamp Duty paid in respect of Judicial stamp paper is paid under the Court Fees Act, 1870.

The Judicial Stamp Papers are used for legal purpose or for court cases and are known as court fee Stamp Paper. The judicial Stamp Papers are used for payment of court fee in the court to avoid cash transactions.

Non Judicial Papers are used for documentation like power of attorney, sale deed, rent agreement, affidavits, transfer of immovable properties and moveable properties such as land, buildings, flats, mortgaging or other important agreements etc. The lawyer will tell which type of Stamp Paper is needed for registration. Stamp Papers with different values are available for use as Non Judicial and Judicial Papers such as Rs. 5, Rs. 10, Rs. 20, Rs. 50, Rs. 100, Rs. 500, Rs. 1000, Rs. 5000, Rs. 10000, Rs. 15000, Rs. 20000 and Rs. 25000 are available.

The frequently asked question is whether there is expiry date for the Stamp Paper. Though there is no expiry period prescribed for the Stamp Papers, it is advisable to surrender the unused Stamp Papers within six months from the date of purchase to get refund.

Provision under Section 54 of the Stamp Act 1899 is available to get refund of the value of Stamp Paper within six months from the date of purchase of the Stamp Paper which remained unused or spoiled or rendered unfit or no more useful for the purpose it was purchased. The Section 54 Act says:

Quote:

Section 54 in the Indian Stamp Act, 1899

“Allowance for stamps not required for use.—When any person is possessed of a stamp or stamp which have not been spoiled or rendered unfit or useless for the purpose intended, but for which he has no immediate use, the Collector shall repay to such person the value of such stamp or stamps in money, deducting 93 [ten naye paise] for each rupee or portion of a rupee, upon such person delivering up the same to be cancelled, and proving to the Collector’s satisfaction—

(a) that such stamp or stamps were purchased by such person with a bona fide intention to use them; and

(b) that he has paid the full price thereof; and

(c) that they were so purchased within the period of six months next preceding the date on which they were so delivered: Provided that, where the person is a licensed vendor of stamps, the Collector may, if he thinks fit, make the repayment of the sum actually paid by the vendor without any such deduction as aforesaid”.

— Unquote

This provision however does not prevent the use of Stamp Paper after expiry of six months stipulated for refund. They can still be used for the same purpose for which they were purchased from the vendor. For example while issuing the Stamp Paper, the stamp vendor makes an entry in the record and on the Stamp Paper regarding full details of the person buying the stamp and the purpose for which it was purchased. Such Stamp Paper can be used only for that specific purpose. For example if a Stamp Paper was purchased for sale deed, then it cannot be used for any purpose other than executing a sale deed.

What does the Supreme Court Judgement say on the expiry date of the Stamp Paper? According to Supreme Court Judgement dated 19-02-2008 in the case of Thiruvengada Pillai vs. Navaneethammal and Anr., the stamp papers do not have any expiry period. Relevant extract from SC judgement is reproduced herein below:

Quote:

“The Indian Stamp Act, 1899, nowhere prescribes any expiry date for use of a stamp paper. Section 54 merely provides that a person possessing a stamp paper for which he has no immediate use (which is not spoiled or rendered unfit or useless), can seek refund of the value thereof by surrendering such stamp paper to the Collector provided it was purchased within the period of six months next preceding the date on which it was so surrendered. The stipulation of the period of six months prescribed in Section 54 is only for the purpose of seeking refund of the value of the unused stamp paper, and not for use of the stamp paper. Section 54 does not require the person who has purchased a stamp paper, to use it within six months. Therefore, there is no impediment for a stamp paper purchased more than six months prior to the proposed date of execution, being used for a document.”

– Unquote

However the Stamp Papers issued by certain States like Maharashtra and Gujarat do contain the expiry date for the use of Stamp Papers purchased within which time if the paper remained unused, they cannot be used again nor refund given. The agreements recorded on the expiry dated Stamp Papers remain invalid.

As per the report published in some Newspapers it is understood that the Finance Ministry of India is planning to amend a century old Indian Stamp Act, in which stamp papers will come with a validity of only one year. The purpose of such amendment is to stop misuse of stamp papers by preventing people from buying backdated papers to stake their claims on property in future, even when no deal had happened on such date. In addition to this, electronic payment of stamp duty is proposed under the new bill to check the same issue.

Recent Comments