Survey on Excise duty Labels/ Stamps – 6

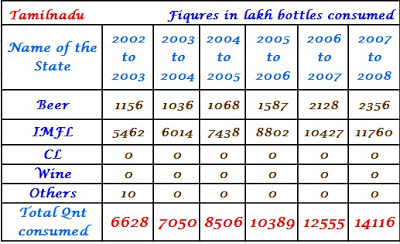

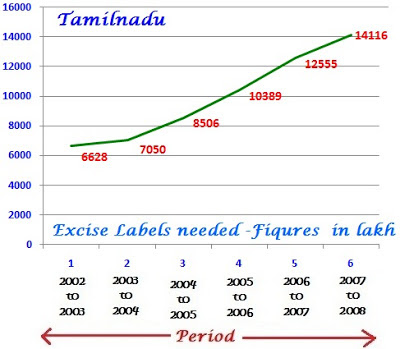

From the above table you can see the gradual increase in the consumption of Liquor in Tamilnadu. The increase every year has been 6 %, 28 %, 57 %, 89 %, 112 %. This thus hreflect on the requirement of Excise duty Labels.

The requirement of Excise Label as per above in 2007-08 works out to 11.36 crores per month. As per the Tender floated by Tasmac the quantity of Polyester Hologram Excise Label required per month will be approximately 25 crore Labels of size 60 mm x 15 mm. The quantity can be increased or decreased or split up at the sole discretion of the Commissioner of Prohibition and Excise. The colors of the seven varieties of Excise Labels are:-

Tamilnadu Excise duty Label- model on bottle

Since Country Liquor is banned no Excise stamps or Labels are issued. As far as Tamil Nadu is concerned, the entire issue of Excise duty Label and Stamps are taken care by TASMAC (Tamil Nadu Marketing Sales Corporation). Tamilnadu ranks third in alcohol consumption after Punjab and Andhra Pradesh and therefore bulk of the use of Holographic Labels are in use here.

Also it is understood that Tamilnadu was the first state to introduce the anti counterfeitable Holographic Excise duty Labels two to three decades back which was subsequently followed by other states. The specification for the Hologram tender as seen in the Tender document floated by Tasmac is as below:

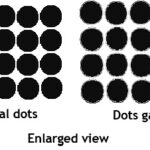

(1) MASTER ORIGINATION : High Security Master made from True 3D and 2D/3D conventional origination system and DOT MATRIX digital origination system of minimum 12000 pixel resolution and with 4000 DPI or more dot resolution recombined together.

- Multi level animation effect

- Four channel effect

- Pearl effect with hidden micro text

- Vast raster image

- Concealed animated image

- Multiple LASER viewable animated covert image

- Kinetic and diffractive animated GUILLOCHE patterns (Randomly computer generated pattern) for high security.

- The logo or emblem and the 3D True Object as suggested by the Tendering Authority shall be incorporated in the hologram.

(3) The master may be changed at the discretion of the tendering authority at any time during the currency of the tender and the tenderer should have the facilities to produce the master within the time frame specified by the tendering authority.

(4) Size and shape: Rectangular , 60 mm (Length) x 15 mm (width)

(6) Colour: Specific colors / Multiple colors. The Department will decide this from time to time.

(7) Thickness: 35 to 40 Microns and suitable for automatic mechanical applicator.

(8) Mastering type : High Security Master made from true 3D and 2D/3D conventional origination system and DOT MATRIX digital origination system of minimum 12000 pixel resolution and with 4000 DPI or more dot resolution recombined together.

- Multi level animation effect

- Four channel effect

- Pearl effect with hidden micro text,

- Vast raster image

- Concealed animated image

- Multiple LASER viewable animated covert image Kinetic and diffractive animated GUILLOCHE patterns (Randomly computer generated pattern) for high security .

The logo or emblem and the 3D True Object as suggested by the Tendering Authority shall be incorporated in the hologram.

(9) Other features:-

- The layers in the Hologram Excise Labels except Micro Text and LASER viewable animated covert image shall be visible to normal eyes.

- The Hologram Labels should have serrated edges all around.

- The Hologram shall not be affected by normal variation in atmospheric conditions.

- The shelf life of the Hologram should be for a minimum of three years without any deformation or deterioration in normal atmospheric conditions.

(10) Coding / Serial numbering: The Hologram Labels should be compatible for Inkjet printing and also Laser etched numbering.

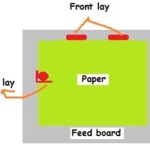

(11) Quality criteria: The quality and adhesion of the Holograms supplied should be suitable to the automatic mechanical applicator.

End Note: Sale of liquor in the state-run TASMAC outlets continue to be a major source of income for the Tamil Nadu government with a whopping Rs 21,680.67 crore earned as total revenue during 2012-13. Besides the revenue the Govt gets on account of Excise duty imposed for the sale of Liquor, the government also earns a revenue of Rs 1.73 crore per month approximately by the sale of excise labels an agency informs.

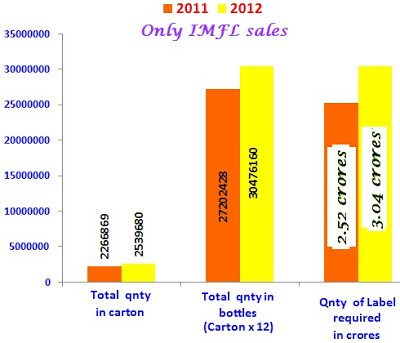

State excise labels are being issued to Indian Made Foreign Spirit (IMFS) and beer manufacturing units and Tamil Nadu State Marketing Corporation (TASMAC) to affix them on the IMFS, beer bottles manufactured locally and those imported from other states with the aim to ensure proper accounting of excise revenue and for preventing the flow of illicit liquor into the state. At present, the average monthly requirement of excise labels is believed to be 24.8 crore, the note said.

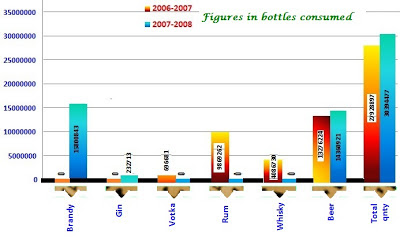

As per another data seen, the Alcohol sales in the state from 2004 to 2008 have registered a 61% increase. Also some data for the year 2006-07, 2007-08 and 2011-2012 were available on consumption of different varieties of Liquor. This will automatically reflect the requirement of Excise Labels. All the figures seem to be incomplete as they have not described the details of all Liquors consumed. However see data shown below to understand the data seen in various places.

CONCLUSION:

The article has been written to work out the average requirement of Excise duty Labels and not meant to study the sale of Liquor. Since the requirement of Excise duty Label is directly related to the consumption and production of Liquors, the study on Liquor consumption pattern was necessary. Many other states like Goa, Pondicherry, Maharashtra, Bihar and Andhra Pradesh too issue Excise duty Labels, but the data could not be collected due to several constraints. However some picture were available from other sources.

Based on the entire data available and analyzing it, I presume that the requirement of Excise duty labels per month in various states where the Excise duty Labels are issued could work out to anywhere from 80 to 100 lakh Labels per month. Finally I would like to repeat the disclaimer as stated below.

However the findings have been reproduced based on the data that we got in person, and in good faith though there is absolutely no reason to doubt that the data supplied to us will be incorrect. At the most they may have some error margins. The data error margins could be 5 – 10 % as conversion from cases to bottles or bulk liters to bottles were difficult to work out since each state worked out the data in their own fashion.

Recent Comments