Withdrawal of Pre 2005 Bank notes

Bank notes in India are currently issued in the denomination of Rs 10/-, Rs 20/-, Rs 50/-, Rs 100 /-, Rs 500/-, and Rs 1000/- by the Reserve Bank of India. These notes are called Banknotes as they are issued by the Reserve Bank of India and not by Government of India.

In one of the most important development, RBI on January 23, 2014, issued notification to all the branch banks informing that all old series of Bank notes issued before 2005 will be completely withdrawn from circulation. A press release was also issued by RBI for the consumption of the public to this effect notifying their decision. The withdrawal of Bank notes included all denominations pertaining to pre 2005 period commencing from Rs 10/- to Rs 1000/- deno bank notes.

The notification of RBI indicated that:

- All older series of banknotes issued prior to 2005 would be acceptable for all kinds of monetary transactions only till March 31, 2014 after which the old currencies are to be exchanged with newer ones.

- In the meanwhile the pre 2005 issued Bank notes received by the banks will not be reissued to the public either over the counters or through ATMs and they have to be forwarded to the Reserve Bank of India.

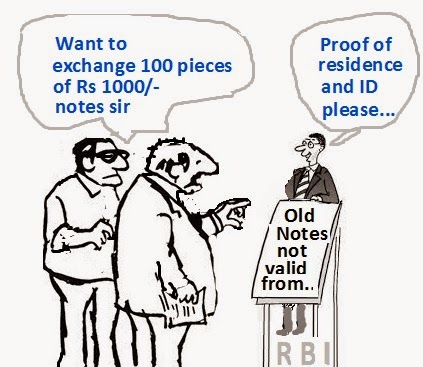

- Thereafter the deadline set, the public will be required to approach branches of the banks which would provide them exchange facilities on an ongoing basis till end of June 2014. However from 1st of July 2014, if one exchanged more than ten pieces of Rs 500/- and 1000/- notes , bank branches should obtain from non-customers proof of their identity and residence, while the clause will not be applicable to the regular customers. Those notes will however continue to be legal tender till March 31, 2014** for all transactions. {** However this deadline has since been extended by Reserve Bank of India till June 30, 2015}.

The announcement by RBI caused consternation and fear in the minds of people because of two past instances. In January 1946, in a surprise move Rs 1000/- and Rs 10000/- currencies which were in circulation were demonetized primarily to curb unaccounted money as stated by RBI even though banknotes in Rs 1000/-, Rs 5000/- and Rs 10000/- were reintroduced in the year 1954. However again to the surprise of the market, banknotes in denominations of Rs 1000/-, Rs 5000/- and Rs 10,000/- were demonetized in January 1978 to curb hording of money by the black marketers.

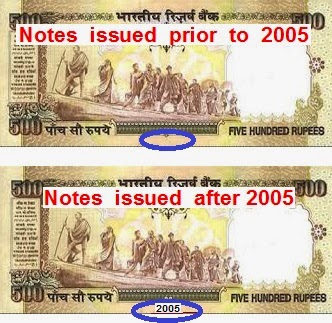

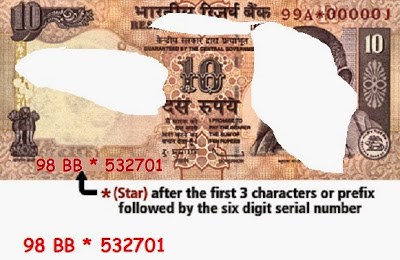

When people were confused on how to identify the Bank notes printed prior to 2005, the banks advised that all the denominational notes which had no imprint of year of printing were pre 2005 issued notes and are to be exchanged. All the Bank notes issued before 2005 do not have the year of printing on the reverse side. In notes issued after 2005, the year of printing is visible at the bottom of the reverse side. The printing of year on the back of the bank notes commenced only from 2005.

Commencing from the year 2005, RBI issued bank notes incorporating the year of printing on reverse of Bank notes with some more additional / new security features compared to the 1996 MG series of bank notes issued earlier. The Bank notes with additional security features in deno Rs 50/- and Rs 100/- were issued in August 2005, followed by Rs 500/- and Rs 1000/- denominations in October 2005, thereafter Rs 10/- in April 2006 and Rs 20/- in August 2006 respectively.

After the announcement to withdraw the pre 2005 Bank notes from circulation at the end of December 2014, RBI has reportedly shredded 144.66 crore pieces of such notes in different denominations valued at Rs 52,855 crore.

One may wonder how many pieces of Bank notes in each denomination may have been actually destroyed in this drive ? As per one data, 73.2 crore pieces of Rs 100 note (Rs 7,320 crore); 51.85 crore pieces of Rs 500 (Rs 25,925 crore), and 19.61 crore pieces of Rs 1,000 (Rs 19,610 crore) have been shredded in the the RBI’s regional offices from January to October 2014. The details of destruction of lower denominations like Rs 10/-, Rs 20/-, Rs 50/- are not available.

Since several representations were received and targeted exchange had not occurred, RBI again issued two notifications extending the dead line for exchange of Pre 2005 issued Bank notes. First it was extended up to January 2015 vide circular dated March 03, 2014. One of the important advise given by RBI in the said circular to the exchanging banks mentioned thus:

Quote:

- …………..You are advised to facilitate the exchange of such notes for full value without causing any inconvenience to the public, whatsoever. These notes will retain their legal tender status and the public can continue to use these for any transaction/ payment.

- ……………..As advised, please issue suitable instructions to all your branches to provide exchange facilities to members of public and to stop re-issue of the pre- 2005 series banknotes. Please also ensure that such notes are not dispensed through the ATMs/ over your counters.

–Unquote

- While implementing this move RBI has not kept any exchange limit. So standard rules like mentioning PAN number in deposit challans while exchanging notes of value above Rs. 50,000/- was insisted. Exchange transactions above 10 lakhs will be reported to Financial Intelligence Unit (FIU) under the Prevention of Money Laundering Act, 2002.

In view of some more practical problems faced, the deadline of January, 2015 for exchanging pre-2005 currency notes of various denominations including Rs 500/- and Rs 1,000/- has been further extended by Reserve Bank of India by another six months i.e till June 30, 2015 till which period the pre 2005 issued bank notes could be exchanged without difficulty.

Seeking cooperation for withdrawing pre-2005 currency notes from circulation, the RBI has asked the public to deposit the pre 2005 issued notes in their bank accounts or exchange them at a bank branch at the earliest but as convenient to them before the deadline notified.

What impact will the RBI move have, and whether the stated intent of RBI is to bring uniformity in the Bank notes printed and to rationalize the notes with new security feature is true? The financial wizards opine that the move by RBI could be actually aimed at attacking the menace of inflow of fake currencies smuggled through neighboring country like Pakistan who is trying to wreck our economy and the banking system. The Government is also serious enough to flush out the black money slashed abroad and unearth the counterfeit currencies. RBI’s present measure will certainly help the Govt in this direction.

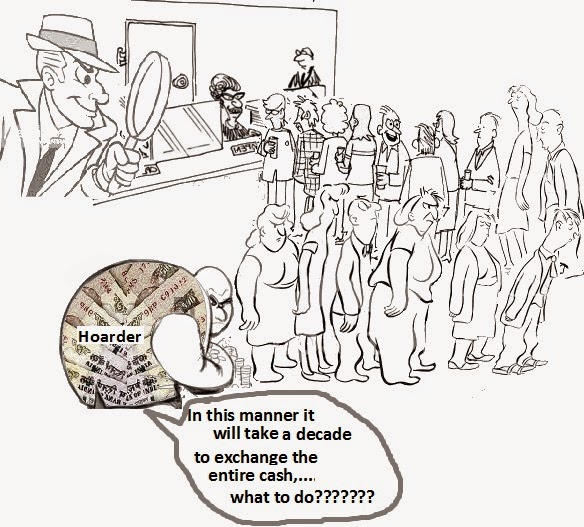

When the new initiative was taken up by RBI, the market was abuzz with rumors that hawala transactions and slashed black money would be converted to gold and the hoarders of cash are clever enough to employ people to get pre 2005 issued Bank notes exchanged through banks. However it is not an easy job to do as any non banking customer exchanging more than ten Bank notes in denominations of Rs 500/- or Rs 1000/- deno will have to provide address proof and PAN number for exchanging notes of value above Rs. 50,000/-. This will certainly add to the problem of the black marketeers and hoarders.

Recent Comments