Guide to Printing Students — 32

-Few objective Questions and answers-

Written by : N.R. Jayaraman

124) What is an Estimate?

An estimate is the application of judgment to forecast the expenditure cum revenues of the organization based on historical experience and the past performance of the organization so as to guide the administrators the manner in which the activities in the organization can be controlled in future. However the day to day estimate for each job quote is the time taken to execute a job, man power required, estimated expenditure to complete the job, the material requirement etc.

125) What is the requirement of an Estimator?

The most important requirement of an Estimator is the technical knowledge in the field he is required to estimate. An Estimator in printing should understand the normal sequence of operations in the printing works. He should have the fundamentals of the printing processes to discuss intelligently the plan of action for the production of each job. He should be thoroughly conversant with the capabilities and limitations of the equipment and machinery in each department. An expert Estimator recognizes the opportunities to exploit the new methods or materials to find out the most economical way to produce the job.

126) What is costing?

Costing is the post process of estimate i.e finding the actual expenditure involved for a given job. Based on it the profit margin is worked out.

127) What is the difference between costing and estimating?

Estimating is to forecast the cost before a product has been actually manufactured or service rendered. The costing is to find out the actual cost involved on the product manufactured including the cost of the defective product manufactured which is waste.

While high technical skills and knowledge is needed for estimating, for costing high accounting skills and knowledge in accounting are necessary. Ultimately both are necessary to decide whether it would be prudent or profitable to continue producing a particular product in future.

128) What is book value of machinery and equipment?

The book value of the machinery and equipment will be the price at which it was procured, plus the freight, insurance, taxes if procured locally and duties levied on them during clearances if imported. Besides these the erection and commissioning expenditures will also be added with it to work out the book value of each machinery and equipment.

Remember that cost of spares will not be added with the book value. However if the spare parts have been procured to specially enhance the utility or efficiency of them, those expenses will also be included in book value of those machinery and equipment. The expenditure involved for laying foundations for the specific machinery and equipment and other civil work will also be not included in the book value of machinery and equipment.

129) What are the basic and aspects or factors considered in costing?

The three main ingredients in costing is as below:

Productive wages: The wages paid for the workers engaged in the production of each job. Example in printing are such as Composing, Lay outing, Pre-press processes directly related to the production of the job etc.

Direct material cost: The direct materials used for the production of the jobs. Examples in printing such as Paper, Ink, films, blocks, binding or other finishing material if any.

Indirect material and consumables needed in pre-press and post press operations for the production of jobs. Example such as proofing material, certain chemicals such as developers etc usable for several jobs, re- usable plates, packing papers for dressing of cylinders etc etc.

Other expenses: All other expenses such as service wages, salaries to clerical and admin staff, purchases etc. However those general expenses are further grouped into several groups, a small percentage of which is added to the cost of each job.

130) What are the other expenses whose expenses are recovered in each job?

The other expenses are as below:

Capital investment: Expenses related to the capital invested such as interest paid if any, depreciation, insurances if any etc

Premises: Expenses related to the building occupied such as infrastructure, rent if paid any, lighting, canteen and other amenities essential.

Power and Electricity: The cost of power and electricity incurred.

Expenses on personnel: Expenses related to the employment of personnel for general management and administration, security and their salaries.

Wages: Expenses related to the wages paid to workmen including wages for holidays, liability insurance etc

Maintenance: Expenditure involved for maintenance of infrastructure, departments, machinery and equipment, storage facilities etc.

Indirect Administrative expenses: Expenses related to the postal services, communication, telephones, yearly audit fee etc

Transport: Expenses related to the delivery of goods and collection of material for production activities and transport charges for other administrative services.

131) How is the hourly cost rate of worker and machinery arrived at ?

The hourly rate is the per hour cost of department engaged against each job that pass through the department. The hourly rate is not common to all the departments in an organization. It varies from department to department as the no of workers engaged in each department and the machinery and equipment differs in each of them. Each department has two hourly cost- one for the labor and the other for machinery and equipment engaged there.

For example the hourly rate of the worker is based on the no of hours actually put in by the worker against each job executed. Supposing out of 48 hours of work performed by a worker for a specific job per week, the worker performs operations such as cleaning, greasing, wash up etc to the extent of 8 hours, then his direct contribution to the work remains only to the extent of 40 hours. Suppose the wages of the workers in that department is Rs 600/- per week, then the hourly cost of the workers chargeable to the customer would not be 600 ÷ 48 =12.5 rupees, but it would be 600 ÷ 40 which would be Rs 15/-. Then only the cost of non-productive hours can be recovered over long run.

Since the figure may vary from year to year on account of wage increases of the worker, generally what is done is the total amount of wages paid to the workers engaged for the total no of jobs processed over a period of past one year in the specific department is taken as base to arrive at the hourly rate of the department on an average for the next year. Keeping in mind the anticipated increase in the wages for the same workers in the next year, the next year’s hourly rate for the same department will be re calibrated accordingly.

However as healthy practice, the hourly rate is not re calibrated for the next few years and maintained static to effectively remain in competition as the processing time of activities also gets reduced with experience thus reducing the total cost than the one actual charged to the customer while confirming the orders.

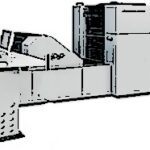

132) How is the hourly rates of the machinery and equipment calculated?

The hourly rate of equipment and machinery comprise of the following elements:

(A) Ownership cost

(i) Depreciation

(B) Operational cost

(i) repair charge

(ii) Operation and maintenance crew charges

(iii) Energy charges

(iv) supplies

These aspects differ from press to press. Each machinery and equipment are purchased at some value and each manufacturer gives warranty or guarantee for smooth working of the same for certain period of life cycle under normal working conditions of 8 hour per shift working with an average speed of x no of hours speed per hour. This is the basis on which the hourly rate of machine is derived at.

Let us see with the following example. A printing machine costs roughly Rs 15 lakhs/- (book value). The manufacturer has guaranteed the working of the machine for 15 years under normal working hours with standard working condition at the end of which the book value becomes zero for the machine though practically it may still be functioning. The question is the period within which the owner decides to recover the investment incurred on the machine. When the owner decides to recover the cost of the machine within 5 years instead of waiting for full 15 years for the machine value to come to zero then how will he work out the hourly rate of the machine?

The following simple arithmetic calculation adapted by most of the presses will give an idea as to how the hourly rate of machines are calculated. It is just for understanding the method and figures given not actual and are imaginary.

He will consider the interest payable for 5 years on the 15 lakhs invested. Let us for example work out the figure as 20 lakhs. Then by simple arithmetic he fixes the per hour rate of the machine as 20 divided by 5 years in which the following factors comes up :

- the no of working days available per week = 6 (one day being holiday) in 8 hour working shift.

- No of working days available per month 31-5 =25 on an average

- Then no of days available per year becomes 25 x 12 = 300 days

- No of working days available for 5 years becomes 1500 days. However due to unforeseen holidays, absenteeism of workers and machine breakdowns only 80 % is taken as workable factor and therefore for calculation it is taken as only 1200 days.

Therefore, if the owner decide to recover the cost of the machine within 5 years he will have to fix per day recovery on the machine approximately to Rs 1666/-. This roughly works out the per hourly rate of the machine as Rs 208/- (1666 divided by 8) without adding depreciation cost, cost of maintenance, spares etc. He adds up all such indirect costs including capital investments, labor etc and fix up the new machine hour rate.

However the norms for the Govt organizations are far different and guided by certain formulas given the administrative heads.

133) What is depreciation of equipment and machinery?

Depreciation of equipment and machinery range from book value to scrap value. Depreciation shall be calculated based on the average of two factors (a) total hours worked with reference to life in hours guaranteed (b) years lapsed since purchased with reference to life in years guaranteed.

134) How is the material cost estimated for specific job and recovered?

The expenses of the material and the quantum of material used is included in the cost. However an important point need to be kept in mind. In the printing presses the direct raw material is paper and ink. Other material used are indirect expenditure involved in each job. The basic material like ink and general printing paper are not purchased on and often and only special paper needed is procured on job basis. The basic material like general paper and Ink are always stocked to certain level and thus becomes the capital raw material and the total cost of the stocked material becomes capital cost of the material locked up. They occupy the space and incur indirect sundry expenses like insurance, handling, transporting, admin etc. Therefore a certain percentage of the total value of the stocked capital item is added along with the total cost of actual directly consumable raw material needed for the job while estimating the unit cost of the raw materials (like hourly rate of the workers) to offset the cost of indirect expenses.

Every manufacturing or product suppliers pay wages to workmen engaged and therefore the wages, cost for the stocked material, cost for the materials purchased, cost for processing, administrative expenditures, building or rent and the overheads. Though the entire cost is not assigned on one individual job, a portion of the expenditure is recovered through them.

However, the ultimate cost involved in the direct production of the individual job consists of the cost of the material used, hourly rates of the machinery and equipment deployed, hourly wages of workmen needed for the completion of the job plus percentage of overheads, building and admin cost to recover the investment plus the profit .

Recent Comments